Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

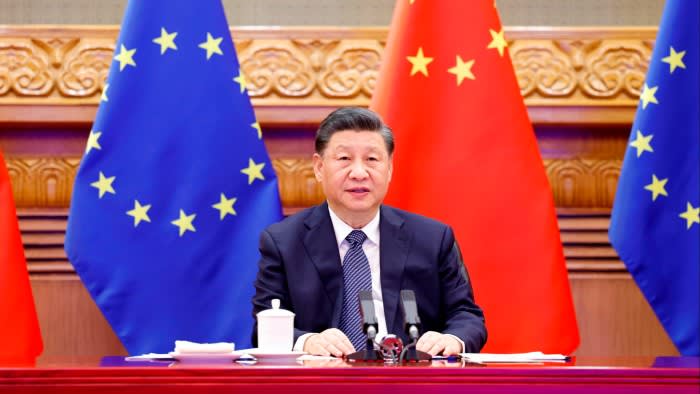

Brussels has raided a Chinese security equipment supplier, deploying new anti-foreign subsidy powers in a move that will further inflame tensions between the trading superpowers ahead of a planned visit by President Xi Jinping to Europe.

The raid by the European Commission and local law enforcement on the offices of an unnamed company in Poland and the Netherlands came as the EU opened a separate investigation into China’s medical device market, as Brussels flexes its muscles against what it sees as Beijing’s unfair trading practices.

The China Chamber of Commerce to the EU decried what it called a “dawn raid” on the security equipment company on Tuesday morning and accused Brussels of “weaponising” its regulatory powers unfairly against Chinese entities.

The move is the first time Brussels has used its new anti-foreign subsidy rules to justify a raid on a company. In February, it used the power to open an investigation into a Chinese train manufacturer.

“The sudden unannounced inspection on April 23 undermines the business environment for foreign companies within the EU in the disguise of foreign subsidies,” the Chinese chamber of commerce said. Neither the chamber nor the EU identified the company.

The EU is China’s second-largest trading partner and one of its most important sources of foreign investment. But tensions have been growing between Beijing and Brussels, with the latter launching several anti-subsidy investigations in recent months.

The bloc has accused China of stoking industrial overcapacity, especially in its electric vehicle and renewable energy sectors, which compete directly with European companies, raising the risk of dumping in EU markets.

The growing friction could complicate a planned trip by Xi to Paris next month, when he is expected to meet his French counterpart Emmanuel Macron.

In a statement, the commission said the raids followed “indications that the inspected company may have received foreign subsidies that could distort the internal market”.

“Unannounced inspections are a preliminary investigative step into suspected distortive foreign subsidies,” it said.

The chamber said enforcement agencies “authorised by the European Commission” had seized IT equipment and mobile phones, scrutinising documents and demanding access to “pertinent data”.

It accused the EU of “weaponising” anti-subsidy investigations to “suppress” Chinese companies and conduct “unjustifiable ‘dawn raids”.

“We call for the provision of a genuinely fair and non-discriminatory business environment for Chinese enterprises,” it said.

The EU on Wednesday said it had also opened an investigation into China’s medical device market on the grounds that European manufacturers were being unfairly blocked from supplying doctors and hospitals.

The commission said Chinese laws, including the “Buy China” policy, were “favouring the procurement of domestic medical devices and services”.

The probe is the first use of a new international procurement instrument. If the EU determines there is discrimination, it can take measures to hinder China’s access to its market.

The raids and anti-subsidy actions raise the spectre of tit-for-tat retaliation. China has countered western accusations of oversupply by arguing that the US and its allies are trying to suppress and contain its industry. It has opened an anti-dumping investigation into French brandy.

During a meeting with German Chancellor Olaf Scholz in Beijing last week, Xi said China’s exports were helping to ease global inflation and support a clean energy transition.

Chinese authorities have also conducted a series of raids on the offices of foreign consultancies over the past year, often without any official explanation or acknowledgment, though these are usually believed to be related to national security.