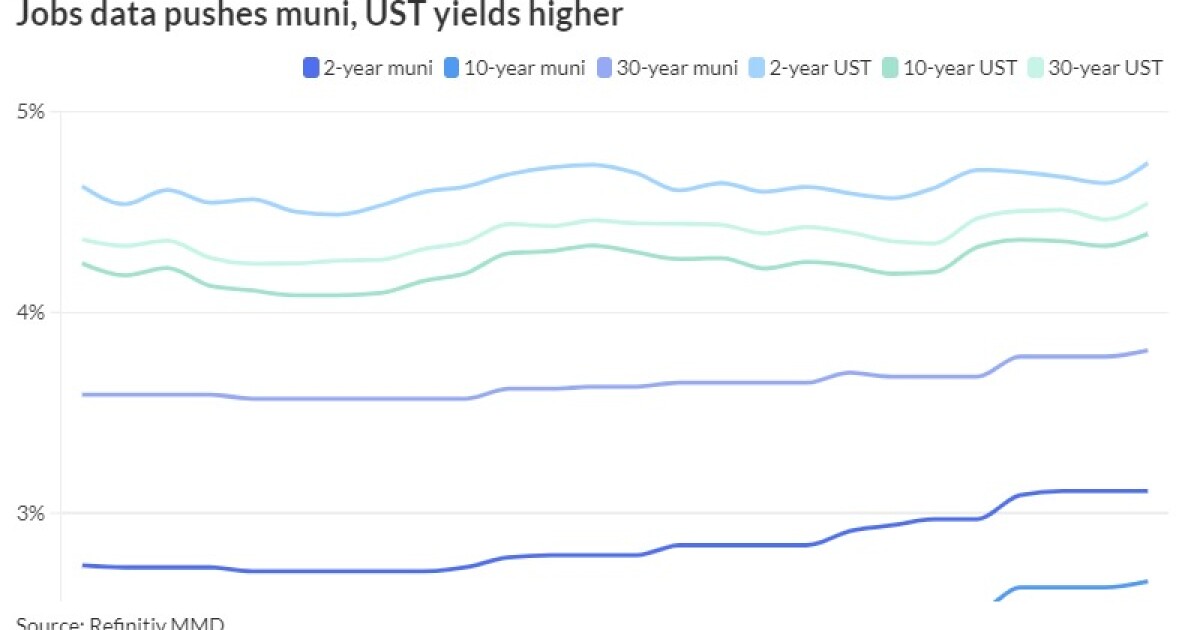

Following another better-than-expected jobs report, U.S. Treasuries sold off and were volatile throughout the session leading municipals to see a weaker, but more muted tone than their taxable counterparts. Equities rallied.

The March employment report sent “the bond market in panic mode over Fed cuts being delayed,” according to Bryce Doty, senior portfolio manager/vice president at Sit Investment Associates.

He sees the Fed cutting rates 75 basis points this year … “a quarter point cut in the third quarter and a half point cut in the fourth quarter.”

As another economic indicator pushed investors closer toward the assumption that rate cuts are farther away, the relationship between munis, USTs and the vast amount of capital sitting on the sidelines grows more complicated, particularly ahead of

Municipal triple-A yield curves saw cuts of one to three basis points Friday while U.S. Treasury yields rose up to 10 basis points on the short end and the 10-year flirted with 4.40% but closed at 4.398%.

The day’s moves led muni-to-UST ratios to dip slightly.

The two-year muni-to-Treasury ratio Friday was at 66%, the three-year at 64%, the five-year at 61%, the 10-year at 61% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 67%, the three-year at 6%6, the five-year at 63%, the 10-year at 63% and the 30-year at 85% at 4 p.m.

“We have long believed that April, and then possibly September/October, are the two periods in 2024 during which muni investors may have opportunities to find some not-so-rich relative value opportunities,” BofA Global Research strategists said in a weekly report.

“The April selloff of Treasuries so far has prevented more reasonable ratio corrections in the longer part of the muni curve,” they said. ”Still, investors may instead settle for better entry yields and somewhat wider credit spread opportunities in April if such ratio correction opportunities refuse to present themselves.”

After what BofA said was a “remarkably stable 1Q24,” muni rates and ratios “rose meaningfully in the first three days of April as the tax filing deadline is approaching.”

The rise in ratios though is still moderate and mostly within the five-year part of the curve. “The recognition of possibly delayed and slower Fed rates cuts is sinking in on the market, causing the Treasury curve to have an uncharacteristic late cycle bear steepening,” they said.

“Differing yield curve twists in munis and Treasuries likely will persist in the first two weeks of April, if not for the entire month,” they said. “As such, ratio cheapening in 10-30 years should continue to be moderate during the tax season.”

Investors will be greeted with a new-issue calendar upward of $8.5 billion with several large credits in both the negotiated and competitive space.

Two large tax-exempt higher education issues are among the largest in the negotiated space with the Massachusetts Development Finance Agency set to price Tuesday $750 million of

The state of Kentucky (A1//AA-/) is set to price $632.830 million of

California leads the competitive calendar with three sales including $442.635 million of taxable various purpose GOs, $441.495 million of taxable various purpose GOs and $600 million of tax-exempt various purpose GOs on Thursday.

Louisiana is set sell $291.445 million of GOs and $97.020 million of GO refunding bonds Tuesday.

As issuance grows, particularly refunding volume, some firms are increasing their expectations for total 2024 issuance, including BofA. They said they are raising their 2024 long-term bond issuance estimate from $400 billion to $460 billion based on the 1Q24’s ”

The Bond Buyer 30-day visible supply sits at $11.68 billion.

AAA scales

Refinitiv MMD’s scale was cut up to three basis points: The one-year was at 3.34% and 3.11% in two years (unch). The five-year was at 2.68% (unch), the 10-year at 2.66% (+3) and the 30-year at 3.81% (+3) at 3 p.m.

The ICE AAA yield curve was cut up to two basis points: 3.34% (unch) in 2025 and 3.12% (unch) in 2026. The five-year was at 2.71% (unch), the 10-year was at 2.69% (+2) and the 30-year was at 3.78% (+2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to two basis points: The one-year was at 3.38% (unch) in 2025 and 3.12% (unch) in 2026. The five-year was at 2.70% (+1), the 10-year was at 2.67% (+2) and the 30-year yield was at 3.79% (+2), according to a 3 p.m. read.

Bloomberg BVAL was cut up to two basis points: 3.33% (unch) in 2025 and 3.11% (+1) in 2026. The five-year at 2.63% (+1), the 10-year at 2.62% (+1) and the 30-year at 3.81% (+2) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.75% (+11), the three-year was at 4.562% (+11), the five-year at 4.389% (+10), the 10-year at 4.398% (+8), the 20-year at 4.656% (+8) and the 30-year at 4.551% (+8) at the close.

Nonfarm payrolls report

The March employment report will not provide the Federal Reserve with the greater confidence it needs to reduce interest rates, although analysts believe the upcoming consumer price index report will hold more sway.

Jobs rose 303,000 while the unemployment rate fell to 3.8%.

“I keep scratching my head wondering why so many people are deciding to get jobs now when millions of job openings have been available for at least a couple of years,” Doty said. “People joining the workforce now must need the jobs. As a result, I’m cautious about how strong the jobs data really is for the economy.”

Another strong expansion in payrolls “suggests there is no slowdown in labor demand growth,” said Fitch Ratings Chief Economist Brian Coulton. Payrolls increases averaged 276,000 the past three months, which he noted is “well above trend and well above pre-pandemic rates.”

Additionally, the imbalances remain, Coulton said, “the unemployment rate went down and wage growth on a three-month-on-three-month annualized basis picked up to 4.4%, the fast rate since last September. Nothing in this print to unlock ‘greater confidence’ in disinflation at the Fed.”

It’s difficult to use a term other than “hot” to characterize this report, according to Josh Jamner, investment strategy analyst at ClearBridge Investments.

“While a strong job print at the margin means less need for the Fed to cut, a cooperative wage picture limits how much impact this jobs report will likely have on the Fed’s thinking,” he said. The coming “inflation data will likely be more important on that front.”

Fed Chair Jerome Powell ”de-risked” the report with “comments that highlighted a desire to look through seasonality and implied a strong labor market did not warrant a delayed cutting cycle,” said Alexandra Wilson-Elizondo, co-chief investment officer for multi-asset solutions within Goldman Sachs Asset Management.

With Fed officials’ recent hawkish tone “and the run-up in commodity prices, there was a lot riding on this print to come in-line with expectations. It did not,” she said.

The labor market remains strong, Wilson-Elizondo said, but “it is no longer overheating given average hourly earnings was in line and that participation rate ticked up slightly.”

She expects the Fed will cut rates “later this year to make the soft landing a reality.”

Slower wage growth and an increase in labor force participation will provide the Fed “some modest comfort,” said Sal Guatieri, BMO senior economist, “but employment is simply growing too fast to loosen the labor market and ease price pressures in the services sector. Look for Fed officials to continue walking back expectations of a near-term rate cut.”

“Not only does this [report] make the fight against inflation more difficult, it puts a potential pin in hopes for an interest rate cut in June,” said Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

“It’s been a week of mixed messages from the Federal Reserve, where cuts are very much still on the table for the year, but policymakers won’t be drawn into giving any guarantees,” she added. “Some corners of the market think cuts could be delayed until 2025, and it’s certainly true that a run of weaker economic data will be needed for these to happen. Investor attention will be squarely focused on big-tech earnings and commentary in the coming weeks, as these industry titans have been a leading cause of wage inflation.”

ING Chief International Economist James Knightley said, “The Fed obviously won’t cut rates soon with jobs this strong and next week’s core CPI likely to remain hot at 0.3%MoM.”

Still, he pointed to the ISM report, which showed contraction in employment components, the NFIB hiring intentions survey, which is at its lowest since May 2020, and rising job layoff announcements as “clear contradictions between official data and what businesses are telling survey compilers.”

“Our assumption remains that the official data will eventually reflect the views expressed by business,” Knightley said, “but it may not come in time for the next FOMC meeting in June.”

The report will raise short-term “fears of further inflationary pressures,” said Giuseppe Sette, president of Toggle AI, but in the medium-term suggests “a healthy economy that’s not showing signs of recession.”

The “blockbuster” report “puts the doves on the back foot once more,” he said. “When the job market is so strong and inflation is resilient, why should the Fed cut at all?”

The stronger-than-expected jobs gain “should give momentum to the soft landing, or even no landing, narrative,” said Lara Castleton, U.S. head of portfolio construction and strategy at Janus Henderson Investors.

“All signs are pointing towards a strong economy with potential for growth to pick up,” she said.

And the Fed “will need to see more compelling data to justify cutting in June with the economy as strong as it seems and inflation still far from their 2% target,” Castleton said.

But Morgan Stanley economists still expect the Fed to lower rates in June. “The data point to a noninflationary expansion of the labor market and do not alter the Fed’s course to a June cut,” they said in a report.

Negotiated calendar:

The Massachusetts Development Finance Agency (Aaa/AAA//) is set to price Tuesday $750 million of Harvard University Issue revenue bonds, Series 2024B. Goldman Sachs.

Kentucky (A1//AA-/) is set to price next week $632.830 million of

The Dormitory Authority of the State of New York (Aa1/AA//) is set to price Wednesday $610 million of Cornell University revenue refunding bonds, Series 2024A, serial 2054. BofA Securities.

The Sacramento Municipal Utility District, California, (Aa2//AA/) is set to price Tuesday $400.305 million of electric revenue refunding bonds, consisting of $378.655 million of Series N-1, serials 2029-2036; and $21.650 million of Series N-2, serial 2036. BofA Securities.

The district is also set to price Tuesday $250 million of green electric revenue bonds, 2024 Series M. J.P. Morgan.

The South Dakota Health and Educational Facilities Authority (/AA-/AA-/) is set to price Wednesday $334.100 million of Avera Health revenue bonds, Series 2024A, serials 2025-2033, 2035-2044, and terms 2049, 2054. BofA Securities.

The Maricopa County Industrial Development Authority (A2//A+/) is set to price Thursday $323.415 million of Honor Health hospital revenue bonds, consisting of $43.030 million of new-issue bonds, Series 2024A, serial 2034; and $280.385 million of forward-delivery refunding bonds, Series 2024D. RBC Capital Markets.

The Marion County School Board, Florida, (/AA//) is set to price Thursday $296.370 million of certificates of participation, Series 2024, serials 2026-2044. BofA Securities.

The Board of Regents of the University of Oklahoma (/AA//) is set to price Tuesday $217.515 million of Build America Mutual-insured general revenue bonds, consisting of $197.410 million of tax-exempt refunding bonds, Series 2024A, serials 2025-2044, terms 2049, 2054; and $20.105 million of taxables, Series 2024B, serials 2025-2039, terms 2044, 2054. Barclays.

The Jersey City Municipal Utilities Authority is set to price Wednesday $195 million, consisting of $30 million of Series 2024A, serial 2025; $80 million of Series 2024B, serial 2025; $50 million of Series 2024C, serials 2025-2044, terms 2049, 2054; and $35 million of Series 2024D, serials 2027-2039, terms 2a44, 2049, 2054. Stifel, Nicolaus & Co.

The Northside Independent School District, Texas, (Aaa//AAA/) is set to price Tuesday $161.885 million of PSF-insured unlimited tax school building bonds, Series 2024A, serials 2025-2044, terms 2049, 2054. Raymond James.

The school district is also set to price Tuesday $118.555 million of PSF-insured variable rate unlimited tax school building and refunding bonds, Series 2024B. FHN Financial Capital Markets.

The Tucson Unified School District No. 1, Arizona, (Aa3/AA/A/) is set to price Tuesday $134.240 million of Assured Guaranty-insured Project of 2023 school improvement bonds, Series A, serials 2025-2043. RBC Capital Markets.

The Delaware State Housing Authority (Aa1///) is set to price Tuesday $125 million of non-AMT senior single family mortgage revenue bonds, 2024 Series B. J.P. Morgan.

Charlotte, North Carolina, (Aa1/AA+/AA+/) is set to price Wednesday $120.510 million of Governmental Facilities and Equipment certificates of participation, Series 2024, serials 2024-2043. PNC Capital Markets.

The Union County Improvement Authority, New Jersey, (Aaa///) is set to price Thursday $102.270 million of Union County Administration Complex Project county-guaranteed lease revenue bonds, Series 2024, serials 2025-2044, terms 2049,2054. RBC Capital Markets.

Competitive

The Orange County Sanitation District, California, (Aaa/AAA/AAA/) is set to sell $138.580 million of wastewater refunding revenue obligations, Series 2024A, at 11:30 a.m. eastern Tuesday.

Denver (Aaa/AAA/AAA/) is set to $129.235 million of GO Elevate Denver bonds, Series 2024A, at 10:30 a.m. Tuesday, and $139.720 million of GO Rise Denver bonds, Series 2024B, at 11 a.m. Tuesday.

Louisiana (Aa2/AA//) is set sell $291.445 million of GOs, Series 2024A, at 10 a.m. Tuesday, and $97.020 million of GO refunding bonds, at 10:15 a.m. Tuesday.

California is set to sell $442.635 million of taxable various purpose GOs, Bid Group A, at 11 a.m. Thursday; $441.495 million of taxable various purpose GOs, Bid Group B, at 11:30 a.m. Thursday; and $600 million of tax-exempt various purpose GOs, Bid Group C, at noon Thursday.

Broome County, New York, is set to sell $123.458 million of bond anticipation notes at 11 a.m. Thursday.

Gary Siegel and Jessica Lerner contributed to this report.