Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Time supposedly waits for no one. But try EDF, where clocks really run slow. France’s state-run utility has announced yet another painful increase in the cost and delivery date of its Hinkley Point C nuclear power plant in England.

Power from the plant’s first 1.6 gigawatt unit is now not expected until 2030 under EDF’s latest “base case”. That is three years later than the group previously forecast. There is no timetable for the second similarly sized unit.

Yet EDF’s travails at Hinkley may offer a gift to other electricity rivals — including Drax.

Drax’s shares have shed 25 per cent in the past year. It faces uncertainty over the future of its key asset: a 2.6GW biomass plant in Yorkshire. A deficit in expected nuclear generation capacity towards the end of the decade raises the chances UK ministers will extend renewable energy subsidies for Drax.

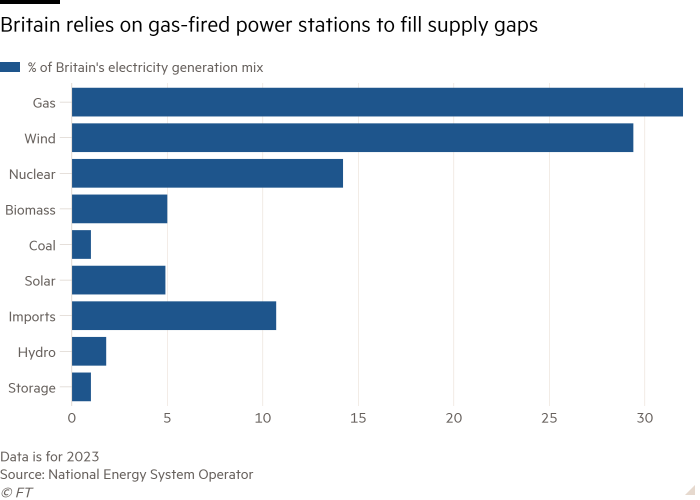

Britain’s five current nuclear power plants, with a collective generation capacity of just under 6GW, accounted for 14 per cent of the country’s electricity mix in 2023. By the end of 2028, only one of those — a 1.2GW plant — will still be open. That plant requires refuelling every 18 months for 60 days. That could mean periods between 2028 and 2030 when no nuclear power is available. EDF is examining whether the decommissioning of other plants can be delayed. Lengthy extensions are unlikely given their age, however.

Meanwhile, the long-term future of Drax’s plant relies on converting it to so-called negative emissions technology from 2030. That would involve the government bridging a three-year gap between when current biomass subsidies end in 2027 and when anticipated new negative emissions agreements would kick in.

In 2023, subsidies accounted for an estimated 13 per cent of Drax’s £7.5bn power generation revenues, according to Visible Alpha.

An investment in Drax is not for the faint-hearted. Environment campaigners vehemently oppose woody biomass. Political announcements knock the share price about. They fell 10 per cent in September when the UK’s spending watchdog announced a probe into biomass.

The result of that probe, published on Wednesday, was not as bad as feared, lifting Drax’s shares 3 per cent.

UK ministers are consulting on extended subsidies for Drax and other biomass plants. Lex has been sceptical of the woody biomass technology Drax uses. But nuclear delays have increased security of supply risks at the end of the decade, says Investec’s Martin Young.

EDF’s problems suggests that Drax’s Yorkshire units may well have to remain online longer than expected. Perhaps its time has come after all.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore