Receive free Global trade updates

We’ll send you a myFT Daily Digest email rounding up the latest Global trade news every morning.

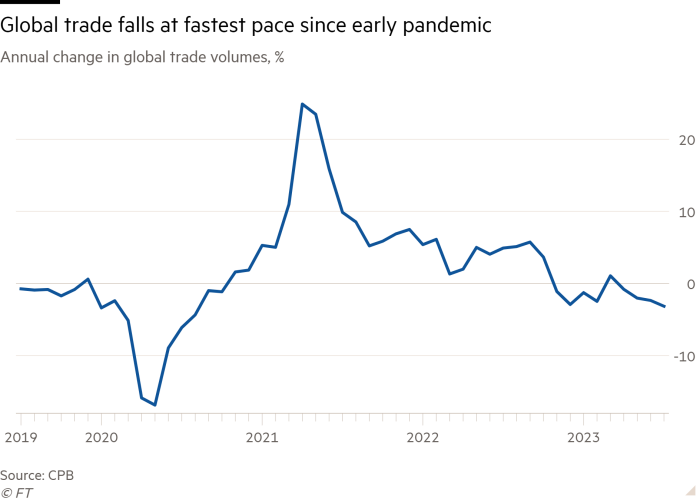

World trade volumes fell at their fastest annual pace for almost three years in July, according to closely watched figures that signal rising interest rates are beginning to impact global demand for goods.

Trade volumes were down 3.2 per cent in July compared with the same month last year, the steepest drop since the early months of the pandemic in August 2020.

The latest World Trade Monitor figure, published by the Netherlands Bureau for Economic Policy Analysis, or CPB, followed a 2.4 per cent contraction in June and added to evidence that global growth was slowing.

After booming during the pandemic, demand for global goods exports has weakened on the back of higher inflation, bumper rate rises by the world’s central banks in 2022, and more spending on domestic services as economies reopened following lockdowns.

The about-turn in export volumes was broad based, with most of the world reporting falling trade volumes in July.

China, the world’s largest goods exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent decrease.

Sentiment indicators suggested that world trade would remain weak in the coming months.

The S&P Global purchasing managers’ index tracking new export orders indicated a sharp contraction in August and September across the US, the eurozone and the UK. Economists now expect eurozone export volumes to be flat on the year, after forecasting an expansion of 2 per cent at the start of the year.

While interest rates are not expected to rise further in the coming months, central banks are unlikely to cut borrowing costs until there is more evidence that underlying price pressures have been contained.

Analysts believe the lack of credit easing will continue to weigh down on exports.

“With the lagged impact of high interest rates likely to weigh more heavily on demand for certain goods, it could be several months before global trade reaches its trough,” said Ariane Curtis, global economist at the consultancy Capital Economics.

Demand for imports of goods that are often bought using borrowed funds — such as cars, home furnishings and capital goods — would weaken the most, Curtis said.

Mohit Kumar, economist at the financial services firm Jefferies, said trade was likely to follow the trend in global economic growth, where he forecast a “slowdown in every single major economy in the coming quarters”.

Along with weaker growth, geopolitical tensions were also hitting trade.

In its latest economic outlook, the Paris-based Organization for Economic Co-operation and Development highlighted how trade restrictions have limited export sales since 2018.

“Geoeconomic fragmentation and a shift to more inward-looking trade policies would curtail the gains from global trade and hit living standards, especially in the poorest countries and households,” the OECD warned.

The CPB also reported that global industrial production fell 0.1 per cent compared with the previous month, driven by sharp falls in output in Japan, the eurozone and the UK.

US industrial output was up 0.7 per cent, raising hopes of a soft landing for the world’s largest economy, with inflation falling back to tolerable levels without triggering a recession.