As investors have flocked to municipal exchange-traded funds in the past few years, more muni active ETFs are being launched in the space to meet more bespoke investor demands.

Market participants note the shift stems from the fragmented muni market, the challenge of trying to replicate the index, and the difficulty of competing in the passive space due to their dominance.

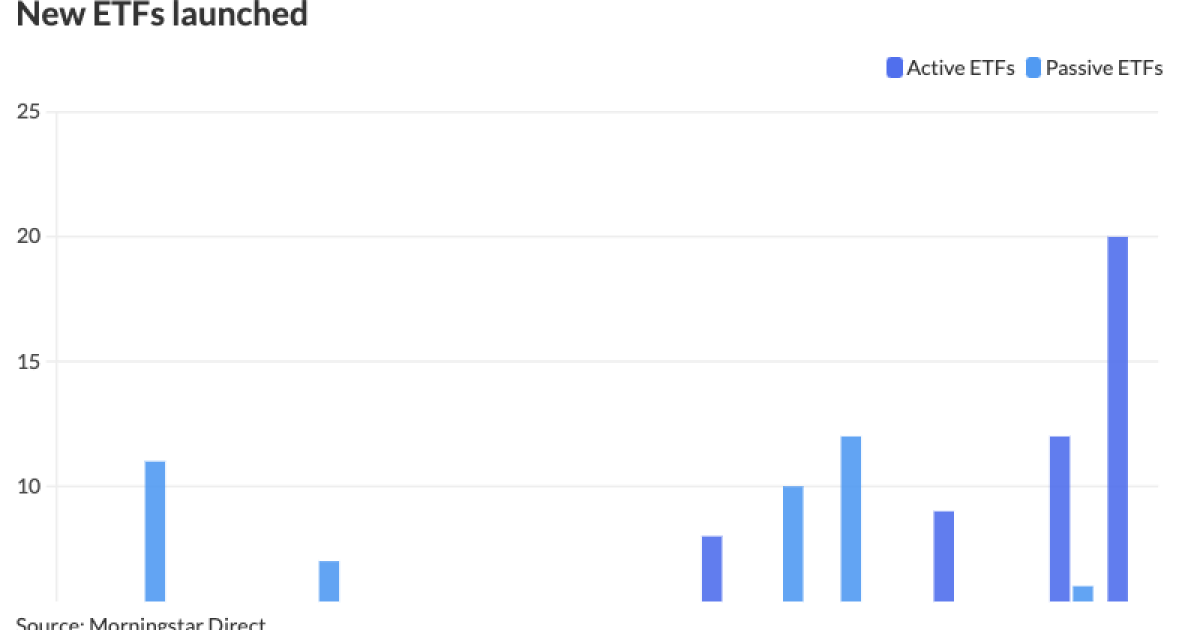

The number of active ETFs launched has grown significantly this year, with 20 new active ETFs year-to-date, including

As inflows into muni ETFs have been substantial — the

With the “good publicity” of active ETFs, it’s a bit of a foregone conclusion they are growing and gaining market share, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

“The way investors are using the ETF universe is starting to change, where they can be a little bit more strategic in trying to target an ETF that is more actively managed and benefit from that,” Brigati said.

That positive momentum will continue, he noted. Brigati said the way in which firms are launching new active ETFs and how they gain market share signals that active ETFs may overtake passive funds in time.

And it was only over the last several years that the number of surviving active ETFs — some ETFs have closed since their launch — has surpassed the number of surviving passive ETFs. Currently, there are 66 active ETFs compared to 44 passive ETFs, the data shows.

However, the total net assets for passive ETFs are more than five times greater than active ETFs. Passive ETFs have $113.322 billion of total net assets, or 84%, compared to active ETFs with $21.56 billion, or 16%, the data shows.

In 2023, active ETFs accounted for 12.3% of total net assets, compared to the 87.7% of total net assets for passive ETFs, according to Morningstar Direct data.

When ETFs first arrived in the muni space in the mid-2000s, it was early in the evolution of overall fixed income ETFs, said Pat Luby, head of municipal strategy at CreditSights.

At the time, there was still debate about what the product would do to market liquidity and how it would behave, he noted.

“There was skepticism about the ETF wrapper,” Luby said. To make it simpler and easier to understand — and easier to position — the passive index was a tracking solution that made it simpler for investors to get access to the muni market, Luby said.

The growth of active ETFs is the “natural evolution,” said Chad Farrington, co-head of municipal bond investment strategy at DWS.

Morgan Stanley Investment Management has two active ETFs: the Eaton Vance Intermediate Municipal Income ETF and the Eaton Vance Short Duration Municipal Income ETF, the latter of which was c

The intermediate ETF has over $50 million, while the short ETF is around $160 million to $170 million, he noted.

Morgan Stanley Investment Management has “constant conversations” about launching additional active ETFs, Brandon said.

“That’s the trend in the market, and you want to be in that business,” he said of active ETFs.

However, ETFs are not the “Field of Dreams,” Luby said, noting that simply launching a muni ETF does not mean investors will flock to that strategy.

“It could be a good manager with a good strategy and good experience,” he said. “That doesn’t necessarily mean that assets are going to begin to accumulate. It takes more than that to launch a successful ETF.

However, with the muni market being disaggregated and the challenges to try to replicate an index and be passive, it makes more sense to launch an active in this market, Farrington said.

For passive ETFs, “you are never going to be able to replicate an index, so … might as well go active and try and beat the index,” Brandon said.