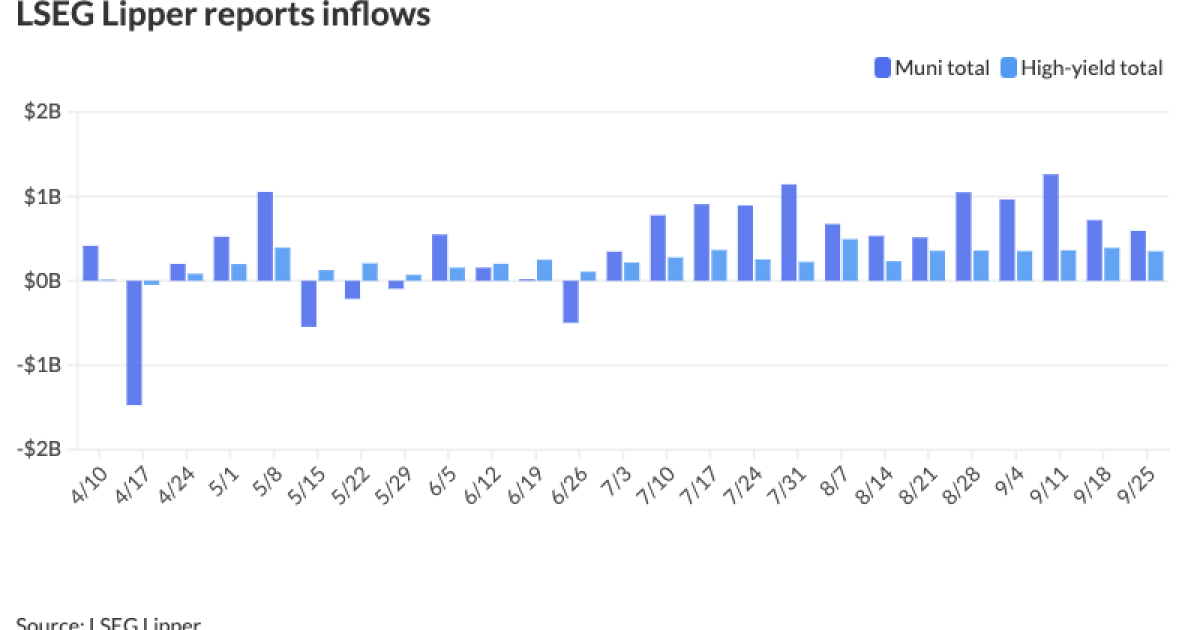

Municipals were steady Thursday as the last large deals of the week priced while municipal bond mutual funds reported the 13th consecutive week of inflows, led by high-yield. Munis were in their own lane, ignoring a mixed U.S. Treasury market while equities rallied.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 64%, the five-year at 65%, the 10-year at 69% and the 30-year at 85%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 85% at 3:30 p.m.

“The metrics that can drive upward municipal rate pressure appear largely absent, despite heavy issuance volume,” said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

In particular, she noted, daily bids wanteds in September are down 15% from the year’s average of $1.05 billion, coming amidst issuance likely to top $40 billion for the month compared to the last decade’s average of $34 billion. Bond Buyer 30-day visible supply sits at $13.98 billion.

Mutual fund flow figures are also supportive, as there have been $8.8 billion of inflows this quarter, according to data from the Investment Company Institute, with only one week of “nominal” outflows, she said.

LSEG Lipper data showed investors added $592.1 million to funds for the week ending Wednesday, following $718.4 million of inflows the week prior. This marks 13 straight weeks of inflows.

High-yield muni issuance totals $20 billion year-to-date, “reflecting normalization from relatively depressed levels in 2023 ($7.6 billion over the comparable period), and now virtually equal to the trailing five-year average for the period ($20.1 billion),” said J.P. Morgan strategists, led by Peter DeGroot.

Even as supply returns to more average levels in the high-yield space, ”demand for yield paper continues to outstrip supply, as funds have seen strong inflows into municipal high-yield ($12 billion) and long-dated ($26 billion) fund categories,” they said.

As inflows increase and secondary trading volumes are more benign, “September is setting up to reverse the usual pattern for the month — when not since 2015 has the 10-year MMD spot finished lower in yield from August,” Olsan said.

Sidelined cash appears to be deployed and additional allocations made to munis by buyers as fixed income garners more attention overall, she said.

“Outsized” supply next month being front-loaded ahead of the election could “jar yields upward, but any moves are likely to be contained in the near-term,” Olsan noted.

“Yield opportunity for high tax bracket investors offers intermediate AA-rated bonds trading around 2.75% with [taxable equivalent yields] of about 4.50% (75 basis points over the UST) and long-dated, AA-rated 5% coupons trading around 3.60% carry TEYs of 6.00% (well above comparable corporate bonds),” she said.

As an example, a benchmark utility offering of the Salt River Project Agricultural Improvement and Power District, Arizona, (Aa1/AA+//) saw 5s of 2034 at 2.72% and a 5s of 2049 at 3.64%.

“Also of note is several larger issues implementing 4% coupon structures past 15 years on the curve, indicative of ongoing support from both individual and corporate-rate buyers on prospects for price gains from future rate rallies,” Olsan said.

In the primary market Thursday, BofA Securities priced for the Texas Water Development Board (/AAA/AAA/) $1.188 billion of state water implementation revenue fund master trust revenue bonds, Series 2024A, with 5s of 4/2025 at 2.81%, 5s of 4/2029 at 2.43%, 5s of 10/2029 at 2.43%, 5s of 4/2034 at 2.85%, 5s of 10/2034 at 2.86%, 5s of 10/2039 at 3.14%, 5s of 10/2044 at 3.50%, 4.375s of 10/2054 at 4.28% and 4.375s of 10/2059 at par, callable 10/15/2034.

Siebert Williams Shank priced for the Aldine Independent School District, Texas, (Aaa/AAA//) $112.75 million of PSF-insured unlimited tax refunding bonds, Series 2024A, with 5s of 2/2031 at 2.63%, 5s of 2034 at 2.85%, 5s of 2039 at 3.18% and 3s of 2042 at 3.76%, callable 2/15/2034.

In the competitive market, Montgomery County, Maryland, (Aaa/AAA/AAA/) sold $445 million of refunding GOs to Morgan Stanley, with 5s of 12/2024 at 2.90%, 5s of 2029 at 2.34%, 5s of 2034 at 2.70% and 5s of 2036 at 2.84%, noncall.

The county also sold $280 million of GOs to Jefferies, with 5s of 8/2025 at 2.62%, 5s of 2029 at 2.35%, 5s of 2034 at 2.73%, 5s of 2039 at 3.00% and 4s of 2044 at 3.69%, callable 8/1/2034.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.50% and 2.30% in two years. The five-year was at 2.31%, the 10-year at 2.63% and the 30-year at 3.52% at 3 p.m.

The ICE AAA yield curve was little changed: 2.53% (unch) in 2025 and 2.32% (-1) in 2026. The five-year was at 2.33% (unch), the 10-year was at 2.63% (unch) and the 30-year was at 3.51% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.52% (unch) in 2025 and 2.32% (unch) in 2026. The five-year was at 2.32% (unch), the 10-year was at 2.61% (+1) and the 30-year yield was at 3.50% (unch) at 3 p.m.

Bloomberg BVAL was little changed: 2.43% (unch) in 2025 and 2.38% (unch) in 2026. The five-year at 2.37% (unch), the 10-year at 2.61% (unch) and the 30-year at 3.49% (-1) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 3.561% (+6), the three-year was at 3.541% (+5), the five-year at 3.558% (+3), the 10-year at 3.790% (flat), the 20-year at 4.175% (-1) and the 30-year at 4.123% (-2) at the close.