Municipal bonds improved Wednesday as attention turned to the primary market with Chicago coming off the sidelines to price its delayed general obligation bond deal along with deals from the Triborough Bridge and Tunnel Authority, the Pennsylvania Turnpike Commission and the Las Vegas Valley Water Department.

U.S. Treasuries and equities closed the session mixed following CPI figures coming in at consensus levels, further baking in a September rate cut.

“While the inflation number this morning gives the Fed the green light to cut rates at their Sept. 18 meeting, the bond market has already rallied a great deal since the end of July with the 2-year UST down over 40 basis points,” said John Kerschner, head of US Securitised Products and Portfolio Manager at Janus Henderson Investors. “We would expect the U.S. bond market to level off at these rate levels and look for more Fed guidance as to whether the rate cut path will be slow and gentle or steeper and more drastic.”

“This argument likely won’t be settled until the current late summer slowdown is over and everyone is back in their seats after the Labor Day holiday,” he added.

Scott Anderson, chief U.S. Economist at BMO Capital Markets, noted the report showed continued progress toward the Fed’s inflation goals. “Nothing in this report would keep the Fed from cutting in September, but market hopes for a bigger cut still seem like a long shot,” he said.

Triple-A yield curves saw levels fall two to three basis points across the curve while USTs were slightly weaker on the short end and better out long.

Muni to UST ratios fell on the short end Wednesday but rose on the 10-year and longer, with the two-year muni-to-Treasury ratio at 65%, the three-year at 69%, the five-year at 69%, the 10-year at 70% and the 30-year at 86%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 68%, the five-year at 68%, the 10-year at 70% and the 30-year at 85% at 4 p.m.

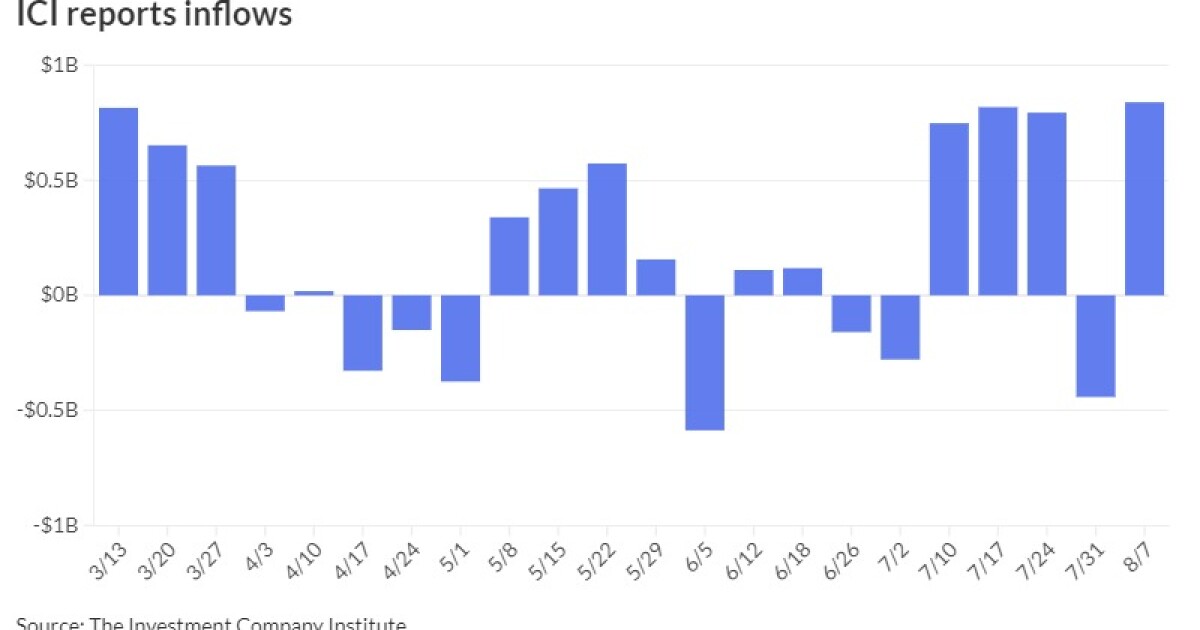

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

Tax-exempt money market funds saw $2.29 billion of outflows for the week ending Aug.12 with the seven-day reset hitting 2.91% with $127.86 billion of assets under management, according to the Money Fund Report, a weekly publication of EPFR.

In the primary market Wednesday, Ramirez & Co. priced for the Triborough Bridge and Tunnel Authority (/A+/AA+/AA+/) $688.245 million of MTA Bridges and Tunnels Revenue Bonds, consisting of $296.27 million general revenue bonds, Subseries 2024 A-1, with 5s of 11/2035 at 3.03%, 5s of 2039 at 3.28%, 5s of 2044 at 3.65%, 5.25s of 2051 at 3.86% and 4s of 2054 at 4.20% (noncall), callable 11/15/2034; and $391.975 million general revenue refunding bonds, Subseries 2024 A-2, with 5s of 11/2025 at 2.71%, 5s of 2029 at 2.71%, 5s of 2034 at 2.95%, 5s of 2039 at 3.28% and 5s of 2044 at 3.65%, callable 11/15/2034.

Huntington Securities, Inc. priced and re-priced for Chicago (/BBB+/A-/A) $646.575 million of GOs with 5s of 1/2041 at 4.02%, 5s of 2044 at 4.20%, 5s of 2045 at 4.24% and 5.25s of 2045 at 4.19%, callable 11/1/2033.

Morgan Stanley & Co. LLC priced for the Health, Educational and Housing Facility Board of the City of Chattanooga, Tennessee, (/A/A-/) $319.41 million of Health System Revenue Bonds (Erlanger Health), Series 2024, with 5s of 12/2033 at 3.43%, 5s of 2034 at 3.45%, 5s of 2039 at 3.66%, 5.25s of 2044 at 3.98%, 5.25s of 2049 at 4.20% and 5.25s of 2052 at 4.28%, callable 12/1/2034.

Raymond James & Associates priced for the Pennsylvania Turnpike Commission (Aa3/AA-/AA-/AA-) $280.820 million of turnpike revenue refunding bonds, with 5s of 12/2026 at 2.70%, 5s of 2030 at 2.76%, 5s of 2039 at 3.30%, 5s of 2044 at 3.68%, callable 12/1/2034.

In the competitive market, the Las Vegas Valley Water Department sold $295.215 million of GO water refunding bonds, Series 2024A, to BofA Securities. Bonds in 6/2031 with a 5% yield 3.73%, 5s of 2034 at 2.85% and 5s of 2039 at 3.21%, callable 6/1/2034.

AAA scales

Refinitiv MMD’s scale was bumped two basis points on the two year and out: The one-year was at 2.65% (unch) and 2.59% (-2) in two years. The five-year was at 2.54% (-2), the 10-year at 2.68% (-2) and the 30-year at 3.56% (-2) at 3 p.m.

The ICE AAA yield curve was better: 2.65% (-3) in 2025 and 2.61% (-3) in 2026. The five-year was at 2.53% (-3), the 10-year was at 2.67% (-2) and the 30-year was at 3.53% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was better: The one-year was at 2.67% (-1) in 2025 and 2.65% (-1) in 2026. The five-year was at 2.55% (-1), the 10-year was at 2.67% (-3) and the 30-year yield was at 3.53% (-3) at 4 p.m.

Bloomberg BVAL was bumped one to two basis points: 2.65% (-1) in 2025 and 2.62% (-2) in 2026. The five-year at 2.56% (-2), the 10-year at 2.62% (-2) and the 30-year at 3.54% (-3) at 4 p.m.

Treasuries were mixed.

The two-year UST was yielding 3.964% (+2), the three-year was at 3.763% (+1), the five-year at 3.675% (-1), the 10-year at 3.831% (-2), the 20-year at 4.212% (-4) and the 30-year at 4.121% (-5) at the close.

Primary calendar

The California Community Choice Financing Authority (A1///) is set to price $1 billion of Athene Annuity-funded Clean Energy Project Revenue Bonds, Series 2024. Goldman Sachs.

The Maryland Economic Development Corporation (A3///) is set to price this week

The New Jersey Health Care Facilities Financing Authority (A2//AA-/) is set to price Thursday $234.515 million of Inspira Health Obligated Group Issues revenue and refunding bonds, Series 2024A. J.P. Morgan.

The Reno-Tahoe Airport Authority (A3/A//A+/) is set to price Thursday $234.510 million of airport revenue bonds, consisting of $156.915 million AMT-bonds, Series 2024A, serial 2025-2044, terms 2049, 2054, and $77.595 million non-AMT bonds, Series 2024B, serial 2027-2044, terms 2049, 2054. BofA Securities.