Municipals closed the month and the first half of 2024 on a quiet note ahead of the Fourth of July holiday-shortened week and a new-issue slate coming in at a measly $240 million — though there was much to watch on the sidelines.

Munis outperformed U.S. Treasuries Friday by holding steady as govies saw some losses and equities were weaker near the close following May personal consumption data coming in largely as expected, further solidifying expected future Federal Reserve moves. This a day after the first U.S. presidential debate.

For the former, “PCE inflation is gradually falling, but it is still above the Fed’s 2% target,” noted Mercatus Center macroeconomist Patrick Horan’s analysis of May PCE inflation data. “I would not expect today’s data release to [change] the Fed’s thinking on interest rate cuts. Right now, we should not expect an interest rate cut before September.”

The market is now “giving the Fed the green light to consider a rate cut at their Sept. 18 meeting,” said John Kerschner, head of U.S. Securitised Products at Janus Henderson Investors. “While Federal Reserve officials are likely to stay on message in the coming weeks, saying they are ‘data dependent,’ we will be paying attention to see if they try to talk down these rate cut expectations or perhaps even reinforce them.”

“We still have two rounds of inflation data before that meeting, and it is looking more and more likely that the slowing inflation data will give the Fed cover to start rate cuts later this year,” Kerschner added.

The markets were less reactionary to the headline-driving Thursday debate between President Joe Biden and former President Donald Trump.

“The U.S. electorate remains polarized, and we expect to see a great deal of discussion over whether investment portfolios should be reexamined,” noted Solita Marcelli, chief investment Officer Americas, UBS Global Wealth Management. “But we think adjusting one’s longer-term financial plan abruptly in the wake of a single debate entails its own risks, and may ultimately prove counterproductive.”

What might have more of an impact on the public finance industry, at least in the nearer term, are U.S. Supreme Court decisions handed down this week, one that found the Securities and Exchange Commission can’t use administrative court proceedings in cases where it seeks civil penalties,

Other SCOTUS decisions to watch are Loper Bright Enterprises v. Raimondo and Relentless, Inc. v. Department of Commerce, which ruled against the so-called Chevron doctrine that allows federal agencies to rely on their own rules and interpretations.

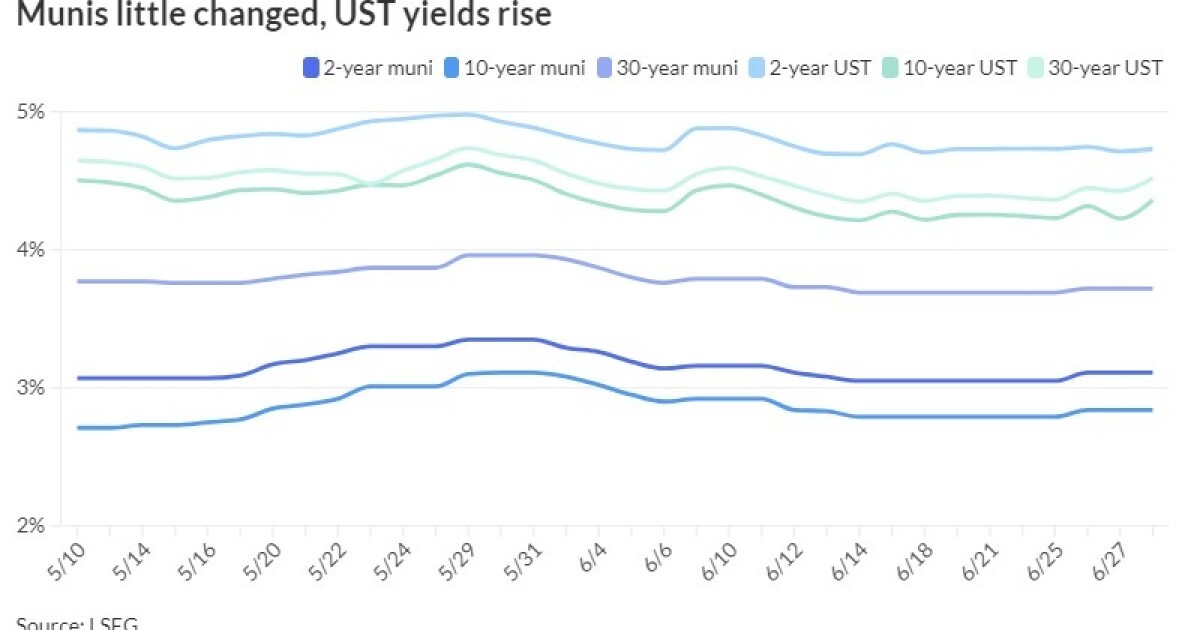

For the public finance-focused participants, the markets this week saw Treasury yields “meaningfully” increase “due mostly to heavy auctions, as well as a plunge in the yen to its lowest level since the mid-1980s,” Barclays PLC strategists said in a weekly report. “Tax-exempt yields have moved largely in line with USTs.”

However, the muni market “successfully pushed through a heavy primary market in June, with muni to Treasury ratios staying relatively tight,” BofA Global Research strategists said in a weekly report.

Indeed, the

Following Friday’s moves, ratios were little changed with the two-year muni-to-Treasury ratio at 66%, the three-year at 66%, the five-year at 67%, the 10-year at 65% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 68%, the 10-year at 68% and the 30-year at 84% at 3:30 p.m.

“As we enter July, supply/demand dynamics will experience a sharp shift in favor of bond investors,” BofA strategists Yingchen Li and Ian Rogow said.

BofA expects $37 billion of new long-term bond issuance in July, ”heavily outweighed by $65 billion of principal redemption and coupon payments,” they said. ”We consider current muni market hesitation as a good opportunity to enter positions ahead of our expected 100-basis-point rally in 2H24.”

Barclays expects July’s issuance to be at least in the mid $30 billion area, also noting that July is the largest redemption month this summer, “and not only in high grade; Puerto Rico redemptions should be close to $1.5 billion,” strategists Mikhail Foux and Clare Pickering said.

They believe technicals in early July should be supportive for the market, “even if yields continue to ascend as we expect, and rate volatility continues.”

Despite this week’s selloff, Treasury yields are down about 20 basis points in June, “which has helped the muni market,” Barclays said.

They noted that high-grade BBBs have outperformed again, but AAAs have also done well, “though they are still in the red for the year.” Single-A and double-A parts of the market have underperformed this month, they said.

Returns as of Friday morning for the Bloomberg Municipal Index show munis at 1.51% in the black for June while still in the red at -0.43% for 2024. High-yield, however, returned 2.46% in June and 4.15% in 2024 so far. Taxable munis are at +1.59% in June and +0.45% in 2024.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.15% and 3.11% in two years. The five-year was at 2.88%, the 10-year at 2.84% and the 30-year at 3.72% at 3 p.m.

The ICE AAA yield curve was little changed: 3.19% (unch) in 2025 and 3.11 (unch) in 2026. The five-year was at 2.92% (unch), the 10-year was at 2.88% (unch) and the 30-year was at 3.72% (flat) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.17% in 2025 and 3.11% in 2026. The five-year was at 2.88%, the 10-year was at 2.88% and the 30-year yield was at 3.70% at 3 p.m.

Bloomberg BVAL was unchanged: 3.17% in 2025 and 3.12% in 2026. The five-year at 2.93%, the 10-year at 2.84% and the 30-year at 3.73% at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.726% (+1), the three-year was at 4.522% (+3), the five-year at 4.341% (+4), the 10-year at 4.355% (+7), the 20-year at 4.616% (+8) and the 30-year at 4.514% (+9) at 3:40 p.m.