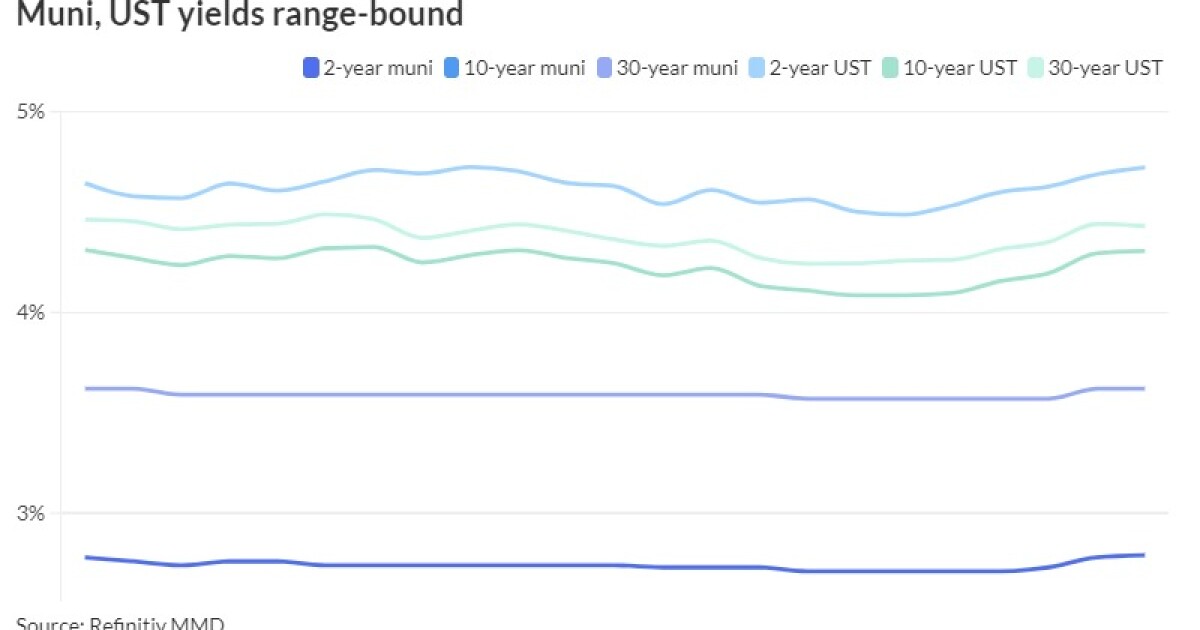

Rich valuations 10-years and in, municipal outperformance to U.S. Treasuries and an overall drumbeat that supply is not meeting demand — yet cash sits sidelined — was the theme for the week.

All else being equal, expectations for more of the same will greet the market next week, along with several New York credits and a high-yield deal out of Suffolk Regional Off-Track Betting Corp.

Market action this week was

Next week’s issuance falls to $5.73 billion, however Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said despite any pickup in supply heading into month-end and into April, it “should not greatly affect the muni market; it would need to be coupled with rate volatility, and if that happens tax-exempts should finally cheapen.

“If not, MMD-UST ratios might adjust slightly higher, but will remain rich by historical standards,” they wrote.

Friday’s moves did little to change the relative value picture.

The two-year muni-to-Treasury ratio Friday was at 59%, the three-year at 58%, the five-year at 57%, the 10-year at 57% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 59%, the five-year at 57%, the 10-year at 58% and the 30-year at 80% at 4 p.m.

Indeed, municipals are outperforming USTs and corporates. Investment grade munis are returning 0.36% month-to-date, inching year-to-date performance closer to the black at -0.02%. High-yield continues to outperform at +1.04% in March and 1.36% in 2024.

Treasuries are returning 0.45% in March and negative 2.71% year-to-date while corporates are in the black at 0.28% in March and -1.40% in 2024.

The new-issue calendar is expected to total $5.7 billion led by the Tuesday pricing of the New York Metropolitan Transportation Authority’s $1.273 billion refunding of climate bond certified transportation revenue refunding green bonds.

The New York State Environmental Facilities Corp. is set to price Thursday $722.505 million of New York City Municipal Water Finance Authority Projects – Second Resolution State Clean Water and Drinking Water Revolving Funds revenue bonds.

The New Jersey Turnpike Authority is set to price Tuesday $500 million of turnpike revenue bonds.

The supply-demand picture does appear to be shifting, with Bond Buyer 30-day visible supply at $8.75 billion while Bloomberg’s net negative supply sits at $6.829 billion.

“While rate volatility returned this week, should the market return to range-bound levels for a protracted period of time, investors might want to add exposure to sectors that provide the most value and have underperformed thus far,” Barclays said. They said prepay gas, investment-grade tobacco and some corporate-backed munis have outperformed the most, “but still has some value.”

For taxable munis, the main focus is still on Build America Bonds, they said,

“It is not clear whether a formal lawsuit will be filed, but we believe that some of the recently issued tax-exempt deals might start trading cheaper as a result,” they said.

They noted that when “an activist investor

From a trading perspective, Barclays said the “ERP ordeal” has mainly affected shorter and intermediate bonds, as well as some of the higher-rated issuers (AAA and AA) that were trading well-through their T+100bp strikes.

“Longer-dated BBBs and a number of single-A bonds were and still are trading wider than their ERP strikes, and their spreads have not been affected,” they said.

“We continue seeing value in these bonds, although their upside might be capped, in our view,” Barclays said. ”Investors should also consider buying BABs that have cheapened and are trading at their ERP strikes, as not all of them will be called, especially in the aftermath of the current legal challenge from bondholders.”

AAA scales

Refinitiv MMD’s scale was left unchanged: The one-year was at 3.00% and 2.78% in two years. The five-year was at 2.45%, the 10-year at 2.45% and the 30-year at 3.62% at 3 p.m.

The ICE AAA yield curve was cut two basis points: 3.02% (+2) in 2025 and 2.81% (+2) in 2026. The five-year was at 2.48% (+2), the 10-year was at 2.48% (+2) and the 30-year was at 3.56% (+1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.99% in 2025 and 2.77% in 2026. The five-year was at 2.46%, the 10-year was at 2.45% and the 30-year yield was at 3.59%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.94% in 2025 and 2.79% in 2026. The five-year at 2.42%, the 10-year at 2.43% and the 30-year at 3.59% at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.732% (+4), the three-year was at 4.509% (+4), the five-year at 4.329% (+4), the 10-year at 4.308% (+1), the 20-year at 4.54% (flat) and the 30-year at 4.43% (-1) at the close.

Negotiated calendar

The Metropolitan Transportation Authority (A3/A-/AA/AA/) is set to price Tuesday $1.273 billion of climate bond certified transportation revenue refunding green bonds, Series 2024A, serials 2028-2045, 2047-2049. Jefferies.

The New York State Environmental Facilities Corp. (Aaa/AAA/AAA/) is set to price Thursday $722.505 million of New York City Municipal Water Finance Authority Projects – Second Resolution State Clean Water and Drinking Water Revolving Funds revenue bonds, Series 2024 A, serials 2025-2044, terms 2049, 2053. Jefferies.

The New Jersey Turnpike Authority (A1///) is set to price Tuesday $500 million of turnpike revenue bonds, Series 2024 B. J.P. Morgan.

The National Finance Authority (A2/// is set to price Wednesday $471.686 million of social municipal certificates, consisting of $235.843 million of Series 2024-1 Class A, serial 2041, and $235.843 million of Series 2024-1 Class X, serial 2041. BofA Securities.

The Suffolk Regional Off-Track Betting Corp. is set to price Tuesday $349.020 million of tax-exempt revenue bonds, Series 2024, terms 2034, 2044, 2053. KeyBanc Capital Markets.

The Northampton County General Purpose Authority (A3/A-//) is set to price Tuesday $323.270 million of St. Luke’s University Health Network Project hospital revenue bonds, consisting of $290.865 million of Series 2024A-1, serials 2025-2044, terms 2049, 2053; and $32.405 million of Series 2024A-2, serial 2044. BofA Securities.

The Board of Trustees of the Colorado School of Mines (Aa2/AA//) is set to price Tuesday $196.740 million of institutional enterprise revenue bonds. Morgan Stanley.

Wisconsin (/AAA/AA+/AAA/) is set to price Tuesday $175 million of transportation revenue refunding bonds, 2024 Series 2. Wells Fargo.

The New Jersey Educational Facilities Authority (A1/AA//) is set to price Thursday $160.065 million of Assured Guaranty-insured Montclair State University Issue revenue refunding bonds, Series 2024 A. Goldman Sachs.

The Los Angeles County Metropolitan Transportation Authority (Aa1/AAA//) is set to price Tuesday $157.415 million of Proposition A first tier senior sales tax revenue refunding bonds, consisting of $114.735 million of tax-exempts, Series 2024A, serials 2025, 2028-2042; and $42.680 million of taxables, Series 2024B, serials 2026-2035. Wells Fargo.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price Tuesday $127.255 million of taxable Class I single family mortgage bonds, 2024 Series B, serials 2026-2034, terms 2039, 2043, 2054. RBC Capital Markets.

Seguin, Texas, (/AA//) is set to price Wednesday $105.495 million of combination tax and limited pledge revenue certificates of obligation, Series 2024, serials 2025-2058. RBC Capital Markets.

Competitive

The Dormitory Authority of the State of New York (/AA/AA/) is set to sell $242.195 million of City University System Consolidated Fifth General Resolution revenue bonds, Series 2024A, at 10:45 a.m. eastern Tuesday.