A yearend rally led to ownership growth by most sectors in the fourth quarter fueled by a surge in retail, separately managed account buying and an uptick in institutional holdings, while year-over-year data shows the continued trend of dwindling bank holdings and dramatic drops in overall ownership by life and property and casualty insurance companies in the space.

The latest Federal Reserve data showed the face amount of munis outstanding ticked up to $4.052 billion, up 0.3% from Q3 2023 and 0.5% from Q4 2022.

The market value of munis also rose to $4.022 trillion, up 6.6% from the third quarter and 3.5% from Q4 2022.

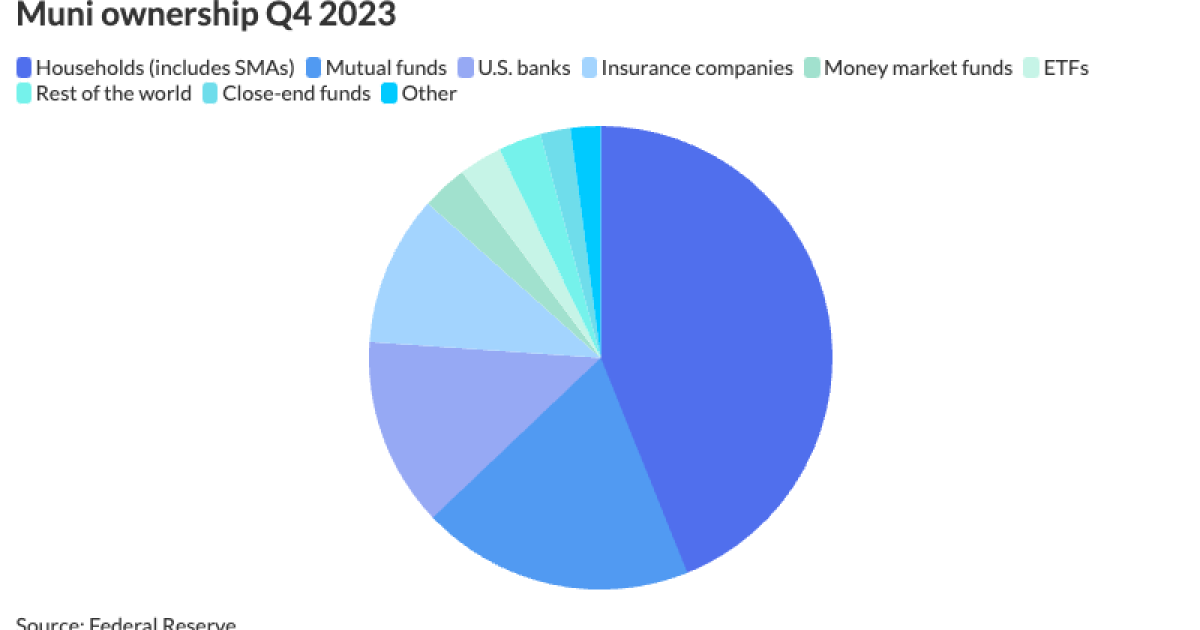

Household ownership of individual bonds remained the largest category of muni ownership at 43.9%, mutual funds at 19%, ETFs at 3% and U.S. banks at 13.2%. Life insurance companies own 5% and property and casualty insurers at 5.6%.

Over the past few years, retail has been a growing portion of the muni market, starting when the reduction of corporate taxes made it less advantageous for insurance companies and banks to own munis, said David Litvack, a tax-exempt strategist and chief investment officer at BofA.

For even with the increase in muni holdings for Q4, “holdings of insurers are at their multiyear lows at the moment,” Barclays PLC noted in a Friday report.

Life insurance companies, which rose 6.5% in Q4 2023 from Q3 2023, is at six-year lows, and property and casualty insurance companies, which rose 4% over the same period, are at the two-decade lows, they said.

Of the increase in muni holdings for Q4 quarter-over-quarter, retail investors remain the main driver of municipal demand, while holdings of institutional investors also increased, but just marginally, Barclays PLC noted.

The “euphoria” surrounding the initially projected seven rate cuts for 2024 and “friendlier” news on the inflation front prompted the fourth quarter rally, said Jeff Lipton, managing director of credit research at Oppenheimer.

There was “heightened interest” in munis given the level of absolute yields offering competitive cash flows.

However, the growth in Q4 was solely due to “falling interest rates” rather than market participants wanting to buy more bonds, Litvack said.

A big driver on the growth in Q4 was due to the

Some participants on the Street estimate that SMAs hold as much as $1.5 trillion of munis while others peg it closer to $1 trillion to $1.3 trillion.

While the Fed does not break out SMAs, household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts, along with SMAs — increased to $1.766 billion, rising 8.8% from Q3 2023 and 9% in Q4 2022.

The

Mutual funds owned 19% of the market at $764.384 billion in Q4, up 5% from Q3 2023 and 2.5% from Q4 2022.

However, if not for the fourth quarter rally, mutual funds in 2023 would have been down year-over-year, Lipton said.

The allocation into muni mutual funds was supported by “very constructive” technicals that drove yearend performance, he said.

The overall transaction costs are more attractive with SMAs as they are not as high as muni mutual funds, Lipton said, noting this trend will continue into 2024 and beyond.

Similar to SMAs, ETF ownership rose, partially due to money leaving muni mutual funds and money market funds, according to Litvack.

ETFs saw ownership climb 13.3% quarter-over-quarter and 17.2% year-over-year to $122.374 billion. ETFs saw $15 billion of inflows in 2023, ICI reports.

ETFs also saw their holdings increase due to attractive after after-tax yields as well as benefiting from tax loss harvesting out of mutual funds and into ETFs, Litvack said.

“People continue to use ETFs as a long-term solution, but also as a cash alternative or a proxy for cash alternatives,” Fabian added.

The growth can also be attributed to the increased number of muni ETFs available, rising to 87 by the end of 2023, said Alice Cheng, a municipal credit analyst at Janney. This is up from March 2023 when there were 75.

Meanwhile, U.S. banks held were at $531.851 billion, up 2.4% quarter-over-quarter but down 8.3% from Q4 2022.

Bank’s reduction of their munis holdings year-over-year can be attributed to “the attrition of bonds maturing and running off the balance sheet,” said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

Banks also “got stung a little bit last year” upon realizing they were unable to easily liquidate all these small municipal positions that they tend to buy, running “into a little bit of a liquidity challenge in that regard,” he added.

With the

For “top depository institutions,” muni holdings are not that significant compared to the “regional depository institutions” where muni holdings are around 20% of their allocations, she said.

Therefore, the selling and liquidating of muni bonds from these depository institutions possibly contributed to the bank’s holding decrease year-over-year because other broker-dealers and households can step in, Cheng said.

Additionally, banks are still cautious as they are still “in the middle of a continuing pressure to get a handle on the value of the assets that they’ve bought,” including commercial real estate, which remains a “major challenge,” Fabian said.

All of this will likely “give pause” in terms of bank allocations into munis, Lipton said.

“That doesn’t mean that they’re all stepping away, and it doesn’t mean you won’t see bank participation, but it does mean we are going to see less allocations from this investor cohort,” he said.