Municipals were steady ahead of a larger new-issue calendar, while U.S. Treasuries and equities were mixed after a better-than-expected jobs report.

High-yield and taxable munis outperformed this week, Bond Buyer 30-day visible supply grows to $13.27 billion with $9 billion plus of it pricing next week and opportunistic cash continues to sit on the sidelines.

This week, USTs “continued to grind tighter, and tax-exempts lagged marginally, although they still remain quite rich,” said Barclays PLC in a Friday report.

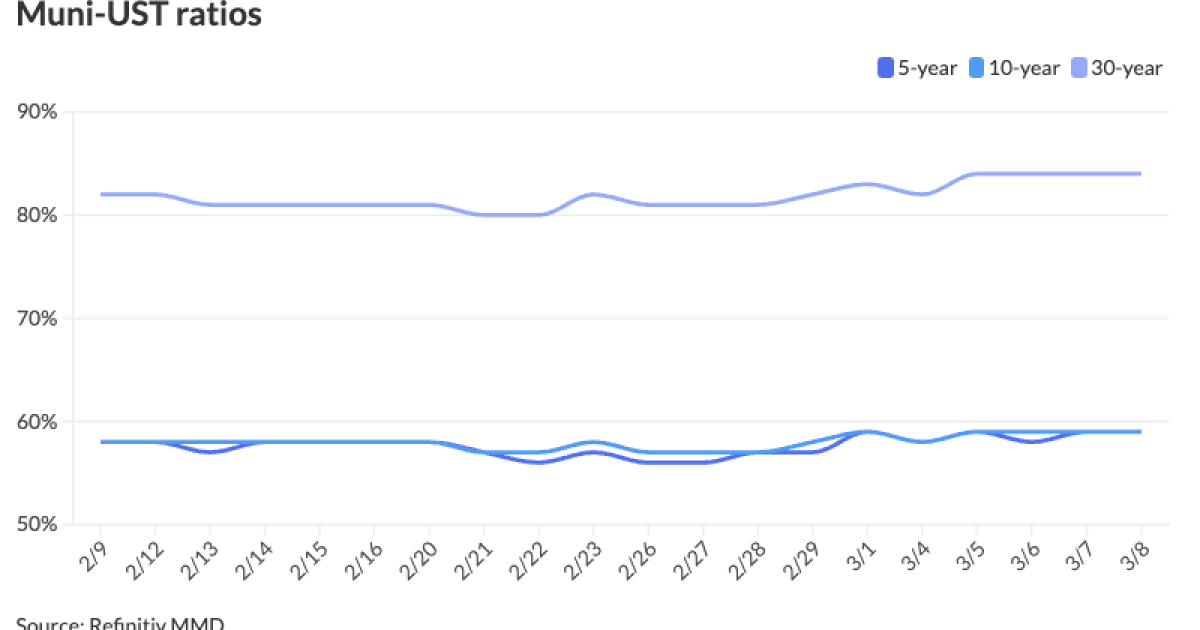

The two-year muni-to-Treasury ratio Friday was at 60%, the three-year at 60%, the five-year at 59%, the 10-year at 59% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 61%, the three-year at 59%, the five-year at 59%, the 10-year at 60% and the 30-year at 83% at 3:30 p.m.

Triple-A tax-exempt muni rates were bumped a few basis points on the week, and while muni-UST ratios “inched up” across the curve, noted BofA strategists.

Taxable munis performed better, outperforming ”the Treasury market across the curve, continuing an emerging trend” that started at the end of October, they said.

Issuance will be heavy next week, with the new-issue calendar estimated at $9.086 billion, with $8.171 billion of negotiated deals and $914.6 million of competitive deals on tap.

The negotiated calendar is led by $3 billion of general purpose state personal income tax revenue bonds from the Dormitory Authority of the State of New York, followed by $2.8 billion from CommonSpirit Health in three deals.

Highly rated Henrico County, Virginia, leads the competitive calendar with $121.355 million of GO public improvement bonds.

Following

They noted this trend could be “short-lived.”

Furthermore, BAB spreads may retrace “some of their losses of the past few weeks, although they are unlikely to get back to the tights any time soon,” according to Barclays strategists.

Municipal bond mutual fund flows “might finally start to turn positive, continuing on this week’s strength, while Treasury yields remain well-behaved for now,” they said.

If that happens, tax-exempts are unlikely to “cheapen” until later in March or April, they said.

On the high-yield side, primary market supply is poised to pick up and the

Inflows are driven in part by the expectation that the Fed is near its peak and the relatively rich valuation on intermediate term high-quality bonds, Miller said. “After 10 years the municipal yield curve gets very steep and credit spreads are still attractive,” he said.

“The anticipation is that in March as soon as next week we’ll see a nice pickup in supply,” Miller said. The supply increase is largely driven by investment grade deals, but “there are a lot of small deals too,” Miller said, noting that this week’s market has brought a few dirt bond deals, charter schools and student housing.

“So there’s a bit of life going on in the primary market for high yield and the fund flows are helping to generate the interest and the liquidity,” he added.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.95% and 2.71% in two years. The five-year was at 2.40% (unch), the 10-year at 2.40% and the 30-year at 3.57% at 3 p.m.

The ICE AAA yield curve was unchanged: 2.97% in 2025 and 2.74% in 2026. The five-year was at 2.42%, the 10-year was at 2.43% and the 30-year was at 3.51% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.93% in 2025 and 2.71% in 2026. The five-year was at 2.40%, the 10-year was at 2.40% and the 30-year yield was at 3.54%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.91% in 2025 and 2.76% in 2026. The five-year at 2.38%, the 10-year at 2.44% and the 30-year at 3.59% at 3:30 p.m.

Treasuries were little changed.

The two-year UST was yielding 4.487% (-2), the three-year was at 4.260% (-2), the five-year at 4.060% (-1), the 10-year at 4.086% (flat), the 20-year at 4.358% (+1) and the 30-year at 4.258% (+1) at 3:30 p.m.

Employment report

The employment report was viewed as a positive by the bond market, which rallied after its release, and it gives the Federal Reserve permission to start cutting interest rates, depending on the upcoming consumer price index report, analysts said.

“The market is now fully pricing in a June cut,” said Lauren Saidel-Baker, an economist with ITR Economics. “The last I checked, four cuts are priced in” for the year, she said, “I think that’s not so far outside the realm of possibility.”

While March is off the table, Saidel-Baker expects cuts by midyear. ”It’s a matter of when not if.”

The key takeaway from the report, she said, was the downward revision to January’s 353,000 jobs added, which was slashed to 229,000.

“I’m not completely shocked to see that January was revised to something a little bit more modest overall between hourly earnings growth cooling,” and “the concentration in job creation,” which skewed toward healthcare and government.

This week, Federal Reserve Board Chair Jerome Powell told Congress the Fed was close to a cut, but needed a little more confirmation.

“I’ll be watching CPI data,” Saidel-Baker said. ”I think the market is still holding its breath a little bit for a little more confirmation.

ITR expects economic growth to cool yet stay positive.

“The jobs report is not as good as it seems,” said Bryce Doty, senior portfolio manager at Sit Investment Associates. “While jobs were higher than expected, so were the large revisions downward for the prior two months. The rising unemployment rate also indicates some underlying weakening in the labor market.”

Since this means “the Fed is likely to still cut rates this year,” he said, “yields should drift lower.”

With the three-month moving average of nonfarm payroll gains at 265,000, Scott Anderson, chief U.S. economist and managing director at BMO Economics, said, there’s “no real sign of a serious slowdown.”

The data, he added, “are right in the sweet spot for the soft-landing scenario the Fed has been hoping for, raising the odds of a mid-year rate cut.”

The numbers should help “the Fed to gain confidence,” said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management. Data, including “the two-month payroll net revision spoke to the larger theme of a tight-but-normalizing labor market.”

The report suggests “a moderation ahead,” said Wells Fargo Securities senior economists Sarah House and Michael Pugliese. “There were material downward revisions to job growth in the prior two months, and the unemployment rate rose to its highest level in just over two years.”

But not everyone agreed. “Labor market tightness is contributing to upward pressure on inflation, particularly in the service sectors of the economy,” said Mortgage Bankers Association Deputy Chief Economist Joel Kan. “The labor market’s continued resiliency is one of several factors keeping mortgage rates from declining much further in the near term, as it increases the likelihood that the Fed will not rush to cut rates.”

Primary to come:

The Dormitory Authority of the State of New York (Aa1//AA+/AA+) is set to price Wednesday $2.985 billion of general-purpose state personal income tax revenue bonds, consisting of $2.845 billion of tax-exempts, Series 2024A, and $140.685 million of taxables, Series 2024B. RBC Capital Markets.

CommonSpirit Health (A3/A-/A-/) is set to price Wednesday $1.737 billion of taxable corporate CUSIPs, Series 2024A; $775.270 million of revenue bonds, Series 2024, through the Colorado Health Facilities Authority; and $246.565 million of revenue bonds, Series 2024, through the California Health Facilities Financing Authority. Morgan Stanley.

The Black Belt Energy Gas District (A1///) is set to price Tuesday $579.075 million of gas project revenue bonds, 2024 Series A. Goldman Sachs.

The Los Angeles Department of Water and Power (Aa2/AA-//AA/) of is set to price Wednesday $352,045 million of power system revenue refunding bonds, 2024 Series A, serials 2024-2044. Siebert Williams Shank & Co.

The Idaho Housing and Finance Association (Aa1//AA+/) is set to price Thursday $331.510 million of Transportation Expansion and Congestion Mitigation Fund sales tax revenue bonds, Series 2024A. J.P. Morgan.

Williamson County, Texas, (/AAA/AAA/) is set to price Wednesday $327 million, consisting of $160 million of Unlimited Tax Road Bonds, Series 2024, and $167 million of limited tax notes, Series 2024. Jefferies.

Clark County, Nevada, (Aa2//AA-/AA-/) is set to price Wednesday $322.100 million of non-AMT airport system subordinate lien refunding revenue bonds, Series 2024A, serials 2025-2032. BofA Securities.

The county (Aa3//AA-/A+) is also set to price Wednesday $152.225 million of non-AMT airport system junior subordinate lien revenue notes, Series 2024B, serial 2029. RBC Capital Markets.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price Tuesday $250 million of residential mortgage revenue bonds, consisting of $150 million of non-AMT bonds, Series 2024A, serials 2025-2035, terms 2039, 2044, 2049, 2054, 2054; and $100 million of taxables, Series 2024B, serials 2025-2032, terms 2039, 2044, 2047, 2054. RBC Capital Markets.

The Ohio Housing Finance Agency is set to price Wednesday $200 million of non-AMT social Mortgage-Backed Securities Program residential mortgage revenue bonds, 2024 Series A. J.P. Morgan.

The California Health Facilities Financing Authority (/AA-/AA-/) is set to price Tuesday $182.250 million of Children’s Hospital of Orange County revenue bonds, consisting of $72.155 million of Series 2024A and $110.095 million of Series 2024B. Morgan Stanley.

The Cass County Joint Water Resource District, North Dakota, (Aa3///) is set to price Tuesday $180 million of temporary refunding improvement bonds, Series 2024A. Colliers Securities.

Ohio (Aaa/AAA/AAA/) is set to price Tuesday $175.125 million of infrastructure improvement GOs, Series 2024A, serials 2025-2043. KeyBanc Capital Markets.

The Public Finance Authority, Wisconsin, is set to price Wednesday $167.810 million of special revenue bonds, Series 2024. Piper Sandler.

The Virginia Housing Development Authority (Aaa/AAA//) is set to price Tuesday $160 million of taxable commonwealth mortgage bonds, 2024 Series A, serials 2025-2033, terms 2039, 2044, 2049, 2054. Raymond James.

The Blue Springs R-IV School District, Missouri, (/AA+//) is set to price Monday $131.225 million of Missouri Direct Deposit Program GO school building and refunding bonds, Series 2024, serials 2025-2040, 2042-2044. Stifel, Nicolaus & Co.

Fairfax County, Virginia, (Aaa/AAA/AAA/)is set to price Thursday $124.135 million of sewer revenue bonds, Series 2024A. Morgan Stanley.

The Cahokia Unit School District No. 187, Illinois, (/AA//) is set to price Tuesday $123.110 million of Assured Guaranty-insured bonds, consisting of $73.110 million of Series A, serials 2025-2044, terms 2049, 2054; $25 million of Series B, serials 2035-2044; and $25 million of Series C, serial 2028-2035. Oppenheimer.

The Louisiana Housing Corp. (Aaa///) is set to price Thursday $110 million of Home Ownership Program single family mortgage revenue bonds, $100 million of non-AMT bonds, Series 2024A, and $10 million of taxables, Series 2024B. Raymond James.

The Louisiana Local Government Environmental Facilities and Community Development Authority (Aaa///) is set to price Wednesday $104 million of American Biocarbon CT Project revenue bonds, consisting of Series 2021 and Series 2023.Jefferies.

The California Municipal Finance Authority (/BBB+//) is set to price Thursday $100 million of Republic Services Project solid waste disposal revenue bonds, Series 2024A, serial 2054. BofA Securities.

Competitive

Henrico County, Virginia, (Aaa/AAA/AAA/) is set to sell $121.355 million of GO public improvement bonds, Series 2024A, at 10:30 a.m. eastern Tuesday.

Gary Siegel and Caitlin Devitt contributed to this story.