Municipals were little changed Thursday as muni mutual funds reported another round of outflows and the final deals of the week priced in the primary. U.S. Treasuries were weaker inside 10 years and equities rallied.

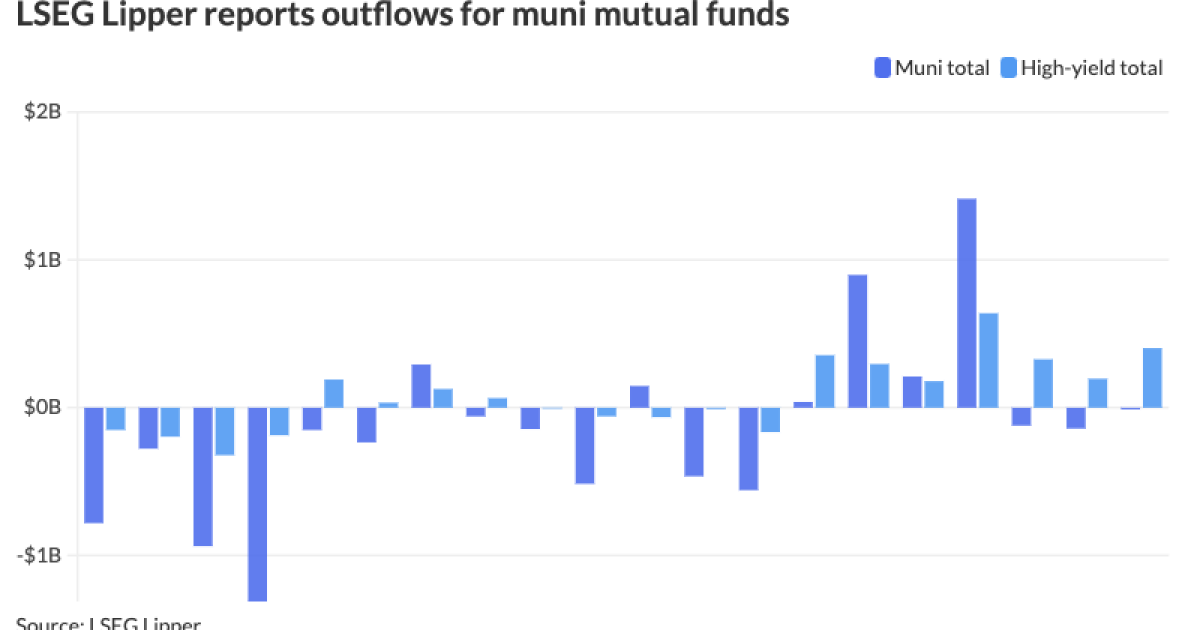

Municipal bond mutual funds saw the third week of outflows, with LSEG Lipper reporting $11.4 million of outflows for the week ending Wednesday after $140.9 million of outflows the week prior.

High-yield once again saw inflows, this week at $402.6 million after $195.9 million of inflows the week prior.

The muni AAA high-grade curve “has moved higher in February, albeit at a far lesser pace than the broader fixed income market,” said J.P. Morgan strategists.

“The 2-5-10-30yr AAA HG scale is indicating sizable outperformance, but given a longer-term perspective, while particularly rich in 10yrs on the curve, absolute yields are still attractive in the context of our longer-term projections for lower rates this year,” they said.

However, the AAA HG curve is “rich on a ratio basis versus the UST market relative to historical averages across the curve,” J.P. Morgan strategists said.

The two-year muni-to-Treasury ratio Thursday was at 58%, the three-year at 57%, the five-year at 56%, the 10-year at 57% and the 30-year at 80%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 58%, the five-year at 57%, the 10-year at 58% and the 30-year at 80% at 3:30 p.m.

In 2-5-10yrs on the curve, they noted “tax-exempt ratios to UST, taxable munis, and corporate bonds are still close to three-year lows, indicating munis are as rich as during the inflow cycle of 2021,” they said.

Taxables remain “particularly compelling” in 10 years on the curve, J.P. Morgan strategists said.

The 30-year spot “continues to represent the most value,” they said. Based on a 21% tax rate, the taxable equivalent yield for 30-year AA 4% tax-exempt bond provides 20 basis points of spread pick-up over similarly structured corporates, they note, while 30-year AA taxable munis have a 20bps spread over AA 30yr corporates.

Supply is expected to increase in the coming weeks, and there may be more rate-direction volatility, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

There has been a historically “consistent, upward-bias theme” between Feb. 1 and March 31, she said.

March 2020 “stands out with the highest volatility due to pandemic-related shutdowns, when the 10-year [BVAL] yield traded off more than 200 basis points but then recovered about 140 basis points into month-end,” Olsan said.

In 2022, the 10-year BVAL yield “fell victim to heavy muni supply and the start of the tightening cycle, with the rate moving from around 1.50% to 2.21% during the month,” she said.

Last year, the best buying opportunity was seen in early March, when the 10-year BVAL yield “traded off about 50 basis points from the prior 30 days,” she said.

2019 was an outlier year performance-wise when the 10-year BVAL yield opened in early February at 2.17% and ended in March at 1.86%.

The average March 10-year BVAL yield move over the past five years is 18 basis points with a median yield of 1.76%, she said.

“A commensurate move in the coming month would take the yield to near 2.75%, or 100 basis points excess to the five-year average,” according to Olsan.

If USTs hold around current levels or rise, J.P. Morgan analysts said “current valuations suggest further cuts” to triple-A scales.

“While there is capital in the system, we caution against chasing the market tighter ahead of expected elevated supply and weaker technicals in the weeks to come,” J.P. Morgan said.

In the primary market Thursday, Wells Fargo priced for the California Infrastructure and Economic Development Bank (A2///) $281.450 million of California Academy of Sciences sustainability revenue bonds, Series 2024A, with 3.25s of 8/2029 at par, callable 8/1/2028.

Barclays priced for the Michigan State Housing Development Authority (Aa2/AA+//) $248.350 million of non-AMT social single-family mortgage revenue bonds, Series 2024A, with all bonds pricing at par – 3.1s of 12/2024, 3.45s of 6/2029, 3.5s of 12/2029, 3.8s of 6/2034, 3.8s of 12/2034, 4.1s of 12/2039, 4.5s of 12/2044, 4.65s of 12/2049 and 4.7s of 12/2053 – except 6s of 6/2054 at 3.95%, callable 6/1/2033.

BofA Securities priced for the Virginia College Building Authority (Aa1/AA+//) $100.760 million of University of Richmond educational facilities revenue and refunding bonds, Series 2024, with 5s of 3/2027 at 2.58%, 5s of 2029 at 2.44%, 5s of 2034 at 2.50%, 5s of 2039 at 2.98%, 5s of 2033 at 3.38%, 5s of 2049 at 3.69% and 5s of 2054 at 3.79%, callable 3/1/2034.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.96% and 2.74% in two years. The five-year was at 2.44%, the 10-year at 2.46% and the 30-year at 3.59% at 3 p.m.

The ICE AAA yield curve was cut one to three basis points: 2.97% (+1) in 2025 and 2.78% (+1) in 2026. The five-year was at 2.47% (unch), the 10-year was at 2.49% (+1) and the 30-year was at 3.58% (+3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.95% in 2025 and 2.75% in 2026. The five-year was at 2.45%, the 10-year was at 2.47% and the 30-year yield was at 3.57%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.96% in 2025 and 2.81% in 2026. The five-year at 2.46%, the 10-year at 2.53% and the 30-year at 3.65% at 3:30 p.m.

Treasuries were weaker inside 10 years.

The two-year UST was yielding 4.715% (+6), the three-year was at 4.494% (+6), the five-year at 4.341% (+5), the 10-year at 4.336% (+2), the 20-year at 4.591% (-2) and the 30-year at 4.475% (-1) at 3:45 p.m.

Primary market on Wednesday

BofA Securities accelerated a $622.765 million of tax-exempt transportation facilities projects revenue refunding bonds, Series 2024A, from the Maryland Transportation Authority (Aa2//AA/), with 5s of 7/2025 at 2.93%, 5s of 2029 at 2.53%, 5s of 2034 at 2.63%, 5s of 2039 at 3.12% and 5s of 2043 at 3.44%, callable 7/1/2034.

FOMC minutes redux

The release of the minutes of the January Federal Open Market Committee meeting didn’t really move the market, analysts said, leaving June and July meetings as the likely timing for the initial rate cut this cycle.

“The market is pricing in about three and a half quarter-point rate cuts before the end of this year,” noted Scott Anderson, chief U.S. economist and managing director at BMO Economics.

Besides showing concern about a premature rate reduction, he said, “some officials noted progress on inflation could stall,” while “only a couple of officials pointed to risks to the economy from waiting too long.”

Staffers assigned “some weight” to the possibility “that further progress on inflation could take longer than expected,” Anderson said, “and saw risks on the economic forecast skewed to the downside.”

The minutes provided no details about possible winding down of quantitative tightening, Anderson noted. “However, acknowledging reductions in the overnight reverse repo usage, many officials said it would be appropriate to start in depth balance sheet discussions at the next meeting.”

The minutes showed Fed officials had a more positive view on inflation and optimism on further progress, according to BNP Paribas economists.

“In line with these views, the committee saw upside risks to inflation as having diminished, with some participants noting the risk that progress could stall,” they said. “Despite this downgrade, most participants still flagged the risks of easing policy too quickly.”

BNP shifted its “QT taper call by one meeting,” expecting more clarity “in March, followed by a formal announcement in May and implementation in June (at which point we expect the Fed to cut Treasury runoff caps in half).”

Taper may take longer than expected, BNP economists said, as the minutes showed “many participants were inclined “to begin in-depth discussions of balance sheet issues at the Committee’s next meeting to guide an eventual decision to slow the pace of runoff.”

But the minutes reflected thoughts from a meeting that occurred “before more recent data depicting much stronger-than-expected inflation,” said José Torres, senior economist at Interactive Brokers.

“The cautious tone of the minutes appears well warranted,” he added, as January inflation numbers were hotter than expected.

“Furthermore, our real-time inflation indicators point to the likeliness of a worrisome inflation increase in next month’s data releases, reflecting the fourth consecutive monthly pickup in price pressures,” Torres said. “This development may raise expectancies of a possible surprise hike by the Fed at their March meeting, which is currently not in the cards.”

Gary Siegel contributed to this story.