An active primary market was the focus Wednesday with the New York City TFA pricing for institutions with small changes to yields from its Tuesday retail offering, Massachusetts upsizing its GO refunding deal and Wisconsin selling green bonds in the competitive market.

Triple-A muni yield curves were mostly little changed to a basis point of stronger in some spots in secondary trading while a slightly weaker tone hit U.S. Treasuries and equities closed in the black.

The two-year muni-to-Treasury ratio Wednesday was at 62%, the three-year at 61%, the five-year at 59%, the 10-year at 59% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 62%, the five-year at 61%, the 10-year at 60% and the 30-year at 82% at 3:30 p.m.

In a clear shift back to tax-exempt municipal money market funds, investors reversed two weeks of outflows to see $3.93 billion of inflows in the latest week. The funds boosted their total assets under management to $120.74 billion for the week ending Feb. 5 from $116.81 billion the week prior, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 0.44% to 3.15%.

The SIFMA Swap Index, meanwhile, fell to 3.24% Wednesday, down from 3.74% or 50 basis points from the week prior, and 131 basis points from 4.55% on January 24, as volatility continues in the VRDO market.

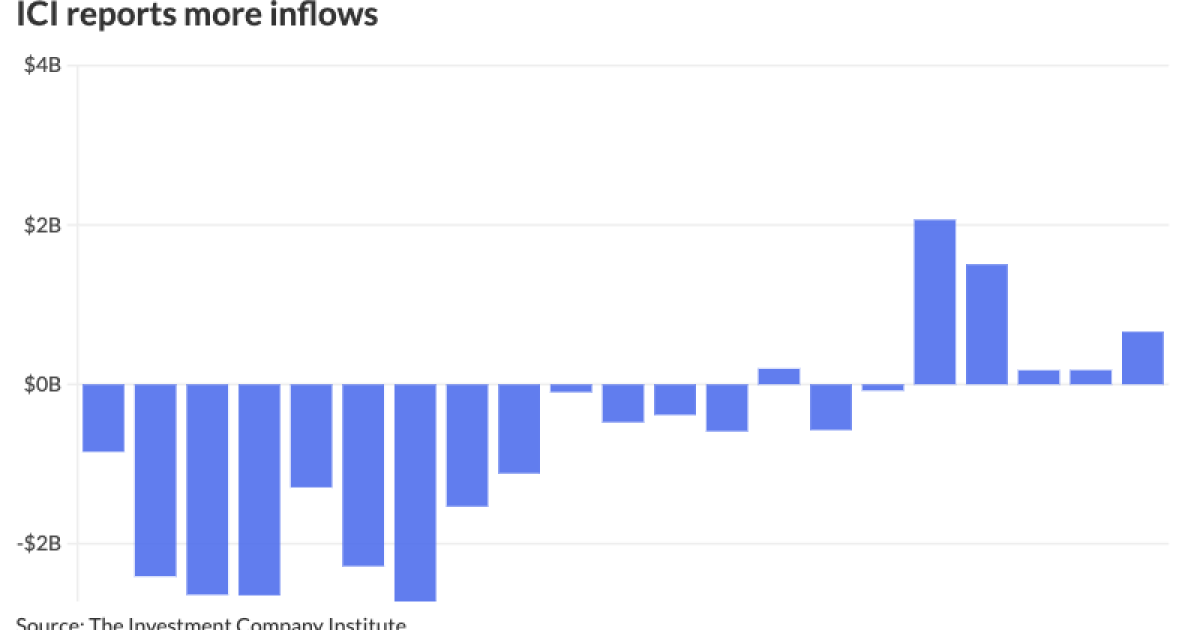

The Investment Company Institute Wednesday reported more inflows into municipal bond mutual funds for the week ending Jan. 31, with investors adding $661 million to funds following $180 million the week prior.

Exchange-traded funds saw inflows of $1.063 billion following $299 million of outflows the week prior.

It will be telling to see the LSEG Lipper report Thursday after the much weaker start to the week.

In the primary market Wednesday, Siebert Williams Shank & Co. priced and repriced for institutions $1 billion of tax-exempt future tax-secured subordinate bonds, Fiscal 2024 Series F, Subseries F-1, from the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with yields cut up to from Tuesday’s retail offering: 5s of 2/2036 at 2.81% (unch), 5s of 2039 at 3.13% (-4), 5s of 2044 at 3.61% (+3), 5s of 2049 at 3.89% (unch), 5.25s of 2054 at 3.97% and 4.25s of 2054 at 4.34% (+2), callable 2/1/2034.

Jefferies priced for Massachusetts (Aa1/AA+/AA+/) an upsized $659.365 million of GO refunding bonds, 2024 Series B, with 5s of 11/2024 at 3.08%, 5s of 2029 at 2.46%, 5s of 2034 at 2.63%, 5s of 2039 at 3.10% and 5s of 2044 at 3.54%, callable 5/1/2034.

J.P. Morgan priced and repriced for the East Bay Municipal Utility District, California, (Aaa/AAA//) $428.260 million of water sewer revenue bonds, with yields bumped three to eight basis points from the preliminary pricing: The first tranche, $246.915 million of green bonds, Series 2024A, saw 5s of 6/2040 at 2.94% (-6), 5s of 2044 at 3.27% (-8), 5s of 2049 at 3.52% (-7) and 5s of 2054 at 3.62% (-8), callable 6/1/2033.

The second tranche, $181.345 million of refunding bonds, Series 2024B, saw 5s of 6/2027 at 2.32% (-5), 5s of 2029 at 2.19% (-4), 5s of 2034 at 2.23% (-3), 5s of 2041 at 3.09% (-5) and 5s of 2044 at 3.27% (-8), callable 6/1/2033.

RBC Capital Markets priced for the San Diego Community College District (Aa1/AAA//) $172.925 million of 2024 dedicated unlimited ad valorem property tax GO refunding bonds, with 5s of 8/2026 at 2.50%, 5s of 2029 at 2.23%, 5s of 2034 at 2.27%, 5s of 2039 at 2.79% and 4s of 2043 at 3.70%.

In the competitive market, the New York City Transitional Finance Authority (Aa1/AAA/AAA/) sold$250 million of taxable future tax-secured subordinate bonds, Fiscal 2024 Series F, Subseries F-2, to Morgan Stanley, with all bonds pricing at par: 4.58s of 2/2026, 4.43s of 2029, 4.72s of 2034 and 4.82s of 2036, callable 2/1/2034.

Wisconsin (/AAA/AAA/) sold $150 million of green Environmental Improvement Fund revenue bonds, Series 2024A, to Wells Fargo, with 8s of 6/2027 at 2.66%, 5s of 2029 at 2.45% and 5s of 2033 at 2.48%, callable 3/1/2033.

Secondary trading

Maryland 5s of 2025 at 2.89% versus 2.91% Tuesday and 2.94% on 1/29. Florida BOE 5s of 2026 at 2.74% versus 2.59%-2.56% Thursday. Wisconsin 5s of 2027 at 2.58% versus 2.42% Thursday.

Georgia 4s of 2028 at 2.51% versus 2.57% on 1/24 and 2.55% on 1/17. California 5s of 2029 at 2.51%-2.48% versus 2.40% on 1/31 and 2.48%-2.47% on 1/29. University of California 5s of 2029 at 2.31%-2.30% versus 2.32% Tuesday and 2.31% Monday.

Connecticut 5s of 2033 at 2.58%-2.57% versus 2.50% Friday. Massachusetts Development Finance Agency 5s of 2034 at 2.71%-2.68% versus 2.74%-2.71% Tuesday and 2.63%-2.68% Monday. University of California 5s of 2036 at 2.42% versus 2.49% Tuesday and 2.57%-2.56% on 1/30.

Triborough Bridge and Tunnel Authority 5s of 2049 at 3.83%-3.84% versus 3.84% Monday and 3.69% original on Friday. Massachusetts 5s of 2054 at 3.90%-3.87% versus 3.74%-3.67% Thursday and 3.84%-3.85% on 1/31.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.99% (unch) and 2.73% (unch) in two years. The five-year was at 2.41% (unch), the 10-year at 2.43% (unch) and the 30-year at 3.57% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 2.99% (unch) in 2025 and 2.77% (unch) in 2026. The five-year was at 2.47% (-1), the 10-year was at 2.46% (-1) and the 30-year was at 3.54% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.00% in 2025 and 2.78% in 2026. The five-year was at 2.46%, the 10-year was at 2.46% and the 30-year yield was at 3.55%, according to a 3 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 2.92% (unch) in 2025 and 2.77% (unch) in 2026. The five-year at 2.42% (-1), the 10-year at 2.49% (-1) and the 30-year at 3.60% (unch) at 3:30 p.m.

Treasuries were slightly weaker.

The two-year UST was yielding 4.424% (+2), the three-year was at 4.196% (+1), the five-year at 4.060% (+3), the 10-year at 4.109% (+3), the 20-year at 4.414% (+3) and the 30-year Treasury was yielding 4.315% (+3) at 3:45 p.m.

January recap

The year got off to a rough start, noted Peter Block, managing director of credit strategy at Ramirez & Co.

“Tax-exempts followed Treasuries lower in January on a slower-than-expected pace of Fed rate cuts,” he said.

The AAA MMD was cut by an average of six basis across the curve, including +6 bps at five years to 2.31%, or a very rich 58% of Treasuries, he said.

Tax-exempts underperformed through 10 years in January but outperformed in 30 years by negative 1.8 ratios to 82% of Treasuries, he said.

In 2023, tax-exempts outperformed USTs but underperformed taxable munis and corporate credit, Block said.

The MMD 2s10s has been inverted since December, “which has pushed demand further out on the curve resulting in flatter 10s30s,” he said.

The SIFMA swap index was volatile last month “with a peak-to-trough of 265 bps in response to money fund redemptions and fluctuations in dealer inventory of VRDOs,” he said.

Issuance should “moderate” in February to $26 billion before picking up in March and April, Block said.

Block predicts issuance will be relatively flat in 2024 at $375 billion, consisting of $313 billion of new-money and $62 billion of refundings.

Flat new-money, along with an expected reinvestment of only around 70% of supply, results in $108 billion of positive net supply that “could, all else equal, provide a negative technical factor for the market during spring and fall,” Block said.

However, a positive is funds seeing inflows to start 2024 with $2.6 billion into mutual funds, according to LSEG Lipper, despite rich muni-UST ratios and spreads, he noted.

Primary to come:

The Illinois Housing Development Authority (Aaa///) is set to price Thursday $495 million of social revenue bonds, consisting of $145 million of non-AMT bonds, 2024 Series A, and $350 million of taxable, 2024 Series B. RBC Capital Markets.

The University of Washington (Aaa/AA+//) is set to price Thursday $304.515 million of general revenue bonds, consisting of $222.190 million of new-issue bonds, Series 2024A, serials 2025-2044; and $82.325 million of refunding bonds, Series 2024B, serials 2024-2041. BofA Securities.

The Clifton Higher Education Finance Corp., Texas, (Aaa///) is set to price Thursday $293.710 million of PSF-insured International Leadership of Texas education revenue and refunding bonds, consisting of $209.810 million of Series 2024A and $83.900 million of Series 2024B. RBC Capital Markets.

The Oklahoma County Finance Authority (A1/A+//) is set to price Thursday $240.825 million of Midwest City-Del City Public Schools Project educational facilities lease revenue bonds, Series 2024. D.A. Davidson.

Competitive

The

Worcester, Massachusetts, is set to sell $159.820 million of GO Municipal Purpose Loan of 2024 bonds, at 11 a.m. Thursday.